PS Cashbook

Child Support Payments

Summary

How do I account for child support payments that need to be deducted from an employees pay and forwarded to the Department of Human Services?

Detailed Description

If child support payments need to be deducted from an employees pay and forwarded to the Department of Human Services, please follow these steps:

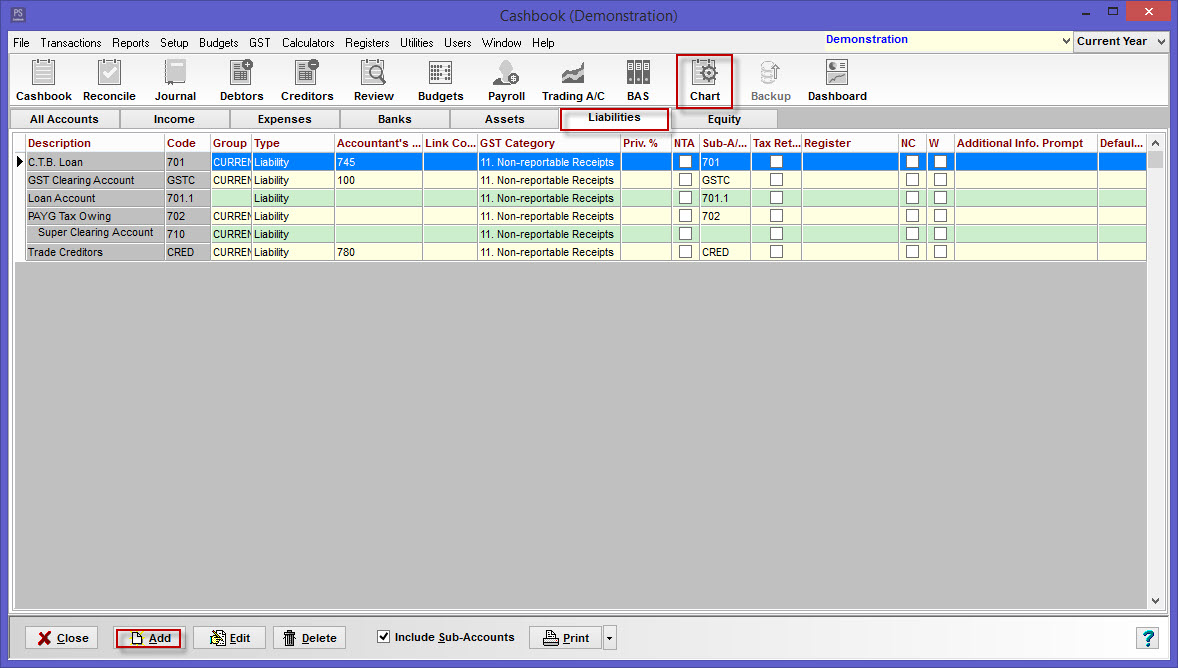

Step 1 - Create a liability account

- Click on the Chart icon on toolbar

- Click on the Liabilities tab

- Click on the Add button

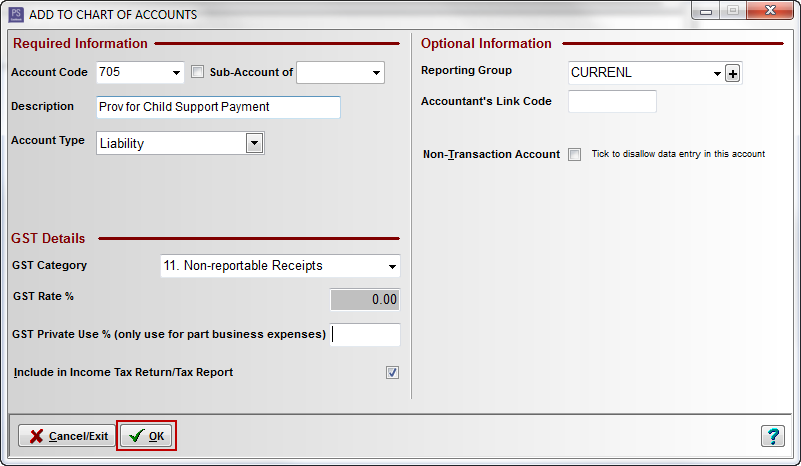

Step 2

- Enter a liability Account Code not currently in use

- Enter a Description (account name) - eg. Prov for Child Support Payments

- Account Type should be Liability

- GST Category should be 11. Non-reportable Receipts

- Click on the OK button to save

- Click on the Cancel/Exit button

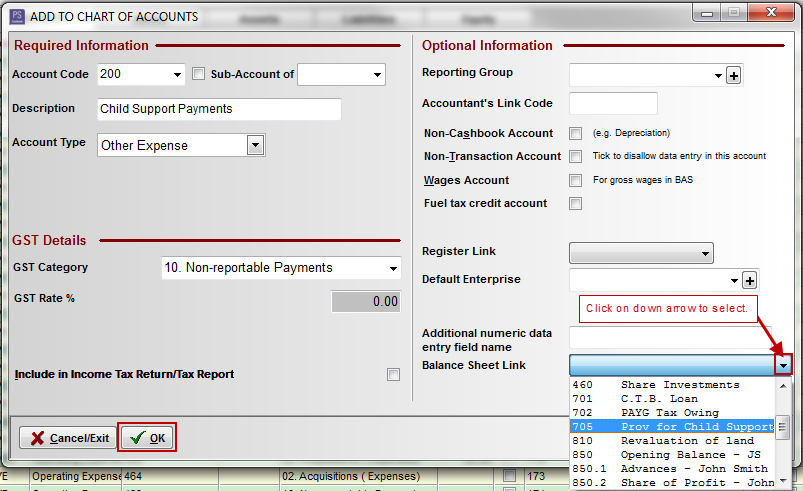

Step 3 - Create an expense account

- Whilst still in Chart.

- Click on Expense tab

- Click on the Add button

Step 4

- Enter an Other Expense Account Code not currently in use

- Enter a Description (account name) - eg. Child Support Payments

- Account Type should be Other Expense

- GST Category should be 10. Non-reportable Payments

- Click on the Balance Sheet Link down arrow to select the Liability account you have just created

- Click on the OK button to save

- Click on the Cancel/Exit button

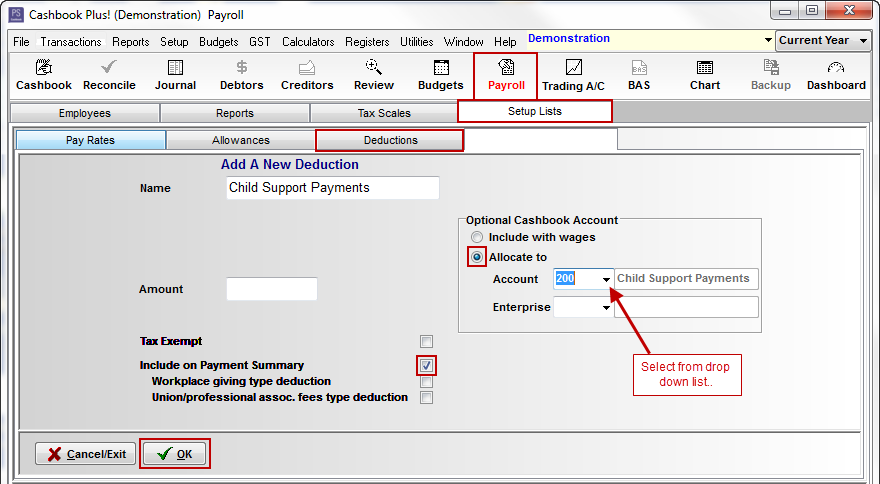

Step 5 - Create a new deduction category

- Click on the Payroll icon on the toolbar

- Click on the Setup List tab

- Click on the Deductions tab

- Add a new deduction details:

- Name (e.g. Child Support Payments)

- Amount - leave this blank

- Tick the Include on Payment Summary check box

- In the Optional Cashbook Account section, click on the Allocate to button and select the expense account created above. (e.g. 200 Child Support Payments) This allows for detailed tracking of the deduction to be added automatically entered in cashbook records.

- Click on the OK button to save

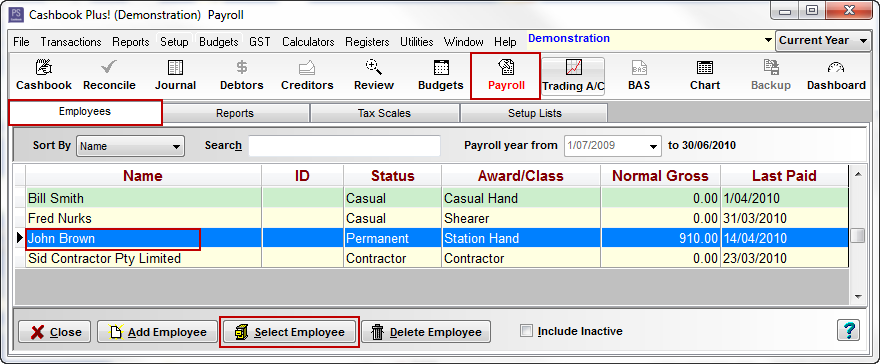

Step 6 - Set up Child Support Payment as a standard pay deduction for the specific employee, so you can deduct the appropriate amount from the employees pay each pay period

- Click on the Employees tab.

- Highlight the applicable employee bu clicking once

- Click on the Select Employee button

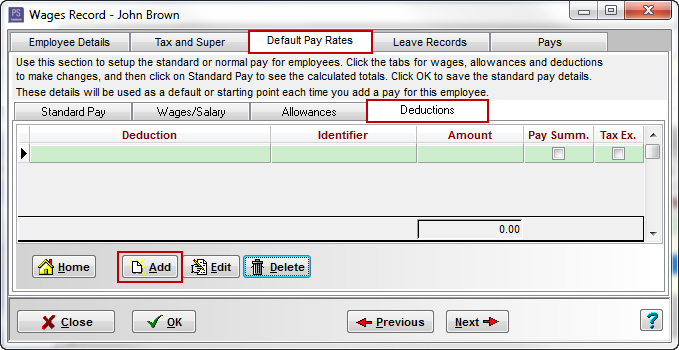

Step 7

- Click on the Default Pay Rates tab

- Click on the Deductions tab

- Click on the Add button

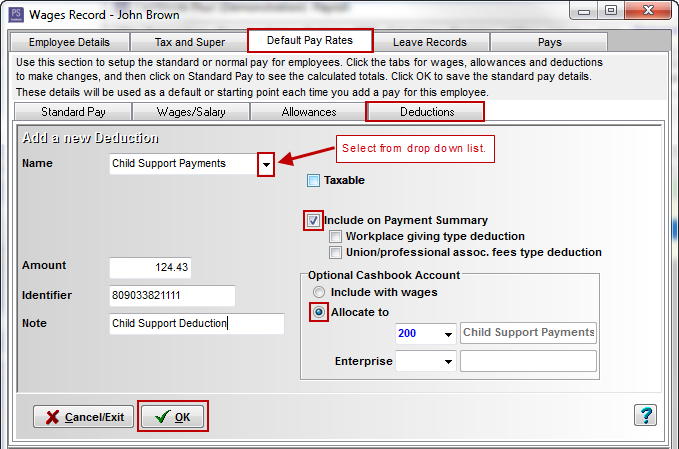

Step 8

- Name - select from drop down list - e.g. Child Support Payments

- Amount - enter amount to be forwarded to Department of Human Services per pay

- Identifier - optional (e.g. Child Support Number)

- Note - optional

- Include on Payment Summary checkbox should automatically default to ticked

- Optional Cashbook Account - this should automatically default to: Allocate to 200 Child Support Payments

- Click on the OK button to save

Now, when you process the employee's pay, the Child Support deduction will automatically be deducted.

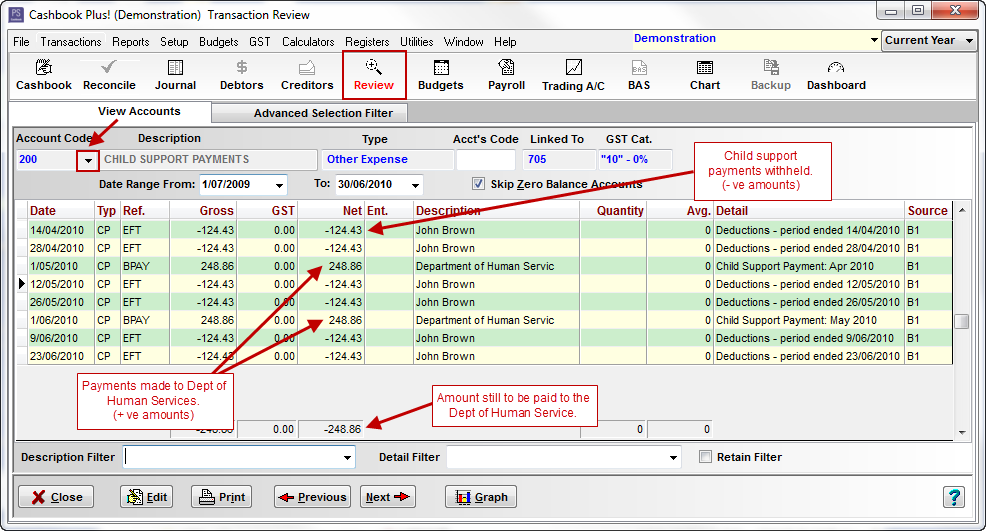

Step 9 - To keep track of the Child Support payments you have withheld and paid

- Click on the Review icon on toolbar.

- Select the Account Code (i.e. 200 CHILD SUPPORT PAYMENTS) to view child support payments withheld and paid.

- Payment withheld are shown as a negative expense.

- Payment made to the Department of Human Services are shown as a positive.

- If the total is 0 - all payments have been made to the Department of Human Services.

Teamviewer

Teamviewer