PS Cashbook

Journal Entries

Summary

What Cashbook reports include journal entries?

When and how should I use journal entires?

Detailed Description

Note: Journal entries are only available in level 3 & 4 of Cashbook Platinum and Cashbook Connect.

The journal entry function provides a convenient method of entering non-cash entries into Cashbook.

These entries will not affect Cash Flow based reports or Cash Basis GST reporting but will be included in Profit & Loss Statement and Assets & Liabilities reports as well as Accrual Basis GST reports.

Typical uses would include recording depreciation, end of year adjustments, accrued expenses, asset revaluations, etc.

Use of the journal function is optional and will probably only be used by experienced bookkeepers and accountants.

Note: that journal entries are made as batch entries where total debits for line items in the journal entry must equal total credits.

** Note again: We do not encourage journal entries and you should check with Accountant before entering.

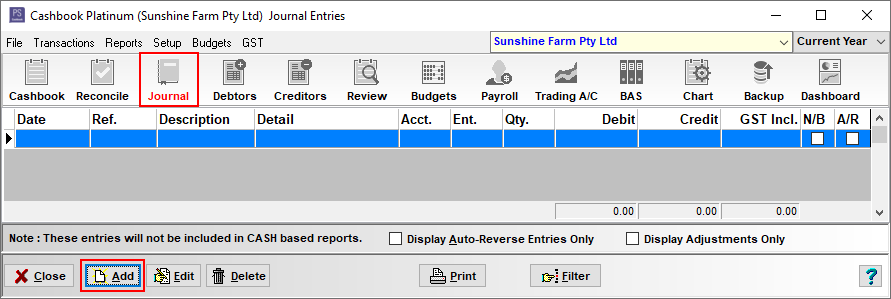

To Add/Edit and Delete Journal entries:

- Click on Transactions > Journal Entries (Non-Cash), or click on the Journal icon on toolbar.

- A list of previously entered journals will be displayed.

- At this point, the options available are:

- Add journal entries.

- Edit previous journal entries.

- Delete a journal entry.

1. Add Journal Entries:

- In the Journal Entries screen, click on the Add button.

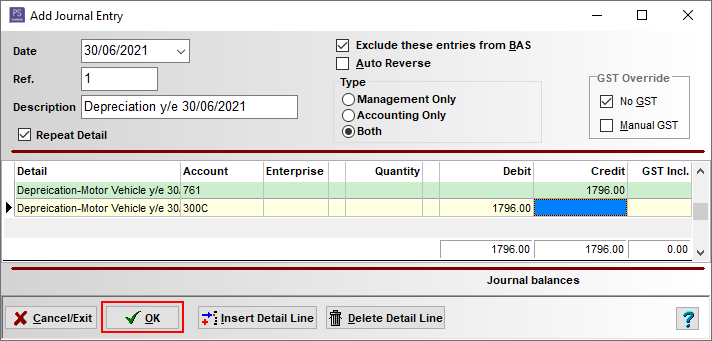

- Complete the following header fields:

- Date

- Reference

- Description

- Tick Repeat Detail check box, if you wish to repeat the journal description on subsequent line entries during the session.

- Complete the following detail fields for each line of the journal entry:

- Detail - description upr to 25 characters (optional).

- Account code - select from the drop-down list.

- Enterprise code - select from drop-down list.

- Quantity - optional.

- Debit or Credit amount.

- GST amount, if applicable.

- Tab to the end of the line or press the <down arrow> key to add more line entries.

- Click the Exclude these entries from BAS checkbox if journal entry has no GST component.

- Click the Auto-Reverse checkbox if you wish to mark the entry as auto-reversing.

- The "GST Override" options for No GST or Manual GST.

- Note: entries must balance - i.e. total debits must equal total credits.

- Click on the OK button to save the entry.

For example: Depreciation of Motor Vehicle. (Depreciation is a reduction in the value of an asset over time, due to wear and tear.)

2. Edit journal entries:

- Click on the Journal icon on toolbar.

- Click on the journal entry you wish to edit/change. (Will be highlighted when selected.)

- Click on the Edit button.

- Make changes.

- Click on the OK button to save.

- Click on the Close button to return to the main menu.

3. Delete a journal entry:

- Click on the Journal icon on toolbar.

- Click on the journal entry you wish to delete. (Will be highlighted when selected.)

- Click on the Delete button.

- Click Yes to Confirm message: "Delete whole journal entry? There are 2 parts to this journal entry. All will be deleted."

- Click on the Close button to return to the main menu.

Teamviewer

Teamviewer