PS Cashbook

Employment Termination Payment (ETP)

Summary

How do I generate a employment termination payment?

Detailed Description

An employment termination payment (ETP) is a payment received by an employee because their employment was terminated. Not every terminated employee receives an ETP - it depends on what the termination pay is made up of and whether any of those payment types fall into the ETP classification. A list of what is destined as an ETP can be accessed here. ETP's are broken down into 'codes' and treated differently for tax purposes. A list of each ETP codes can be accessed here.

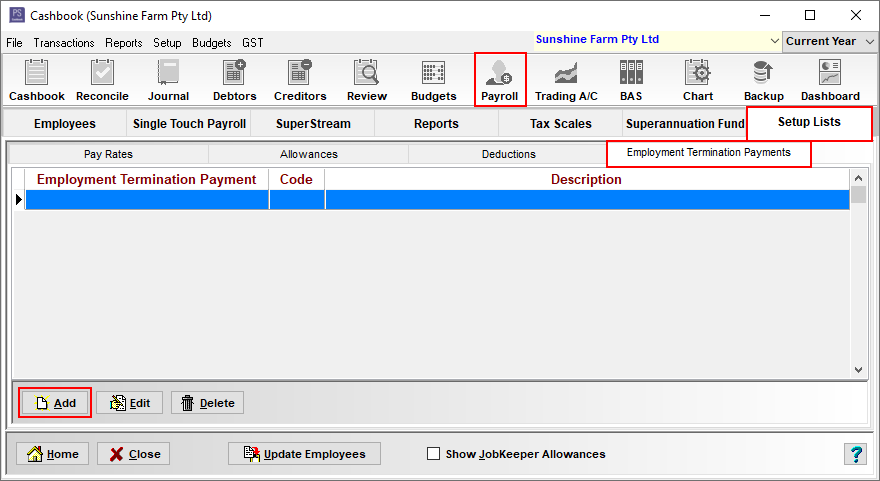

Step 1 - Setup an ETP Pay Type:

- Click on Payroll toolbar option.

- Click on the Setup Lists tab.

- Click on the Employment Termination Payments tab.

- Click on the Add button.

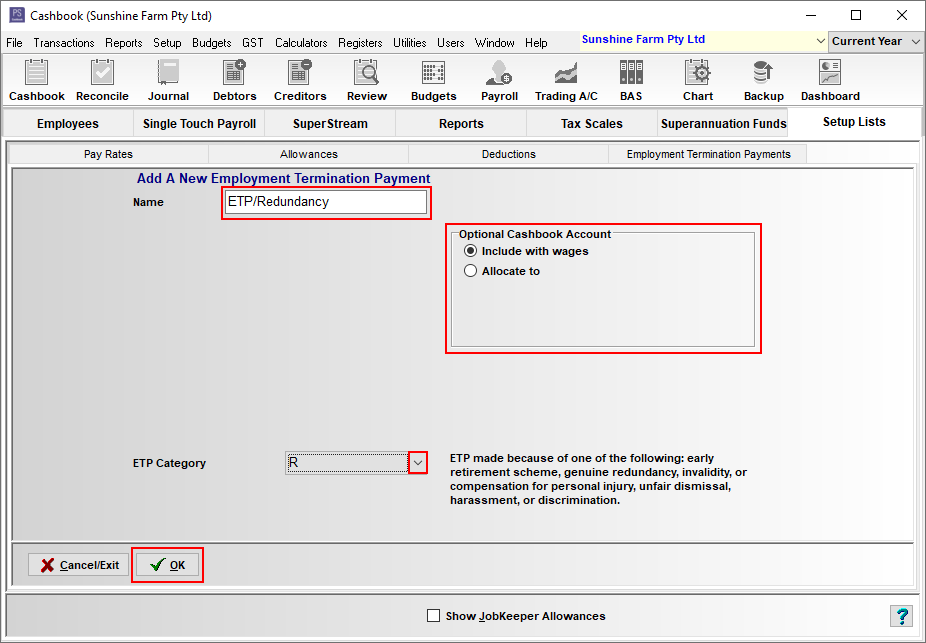

In the Add A New Employment Termination Payment window:

- Enter a Name in the text box. e.g. ETP/Redundancy

- in the Optional Cashbook Account box select either:

- Include with wages

- Allocate to (another account code)

- Select an ETP Category from the drop-down menu. e.g. R (payments due to an early retirement scheme, a genuine redundancy, invalidity or compensation (personal injury, unfair dismissal, harassment or discrimination)

- NOTE: You will need to ask your accountant which category is most applicable to your situation.

- Click OK to save.

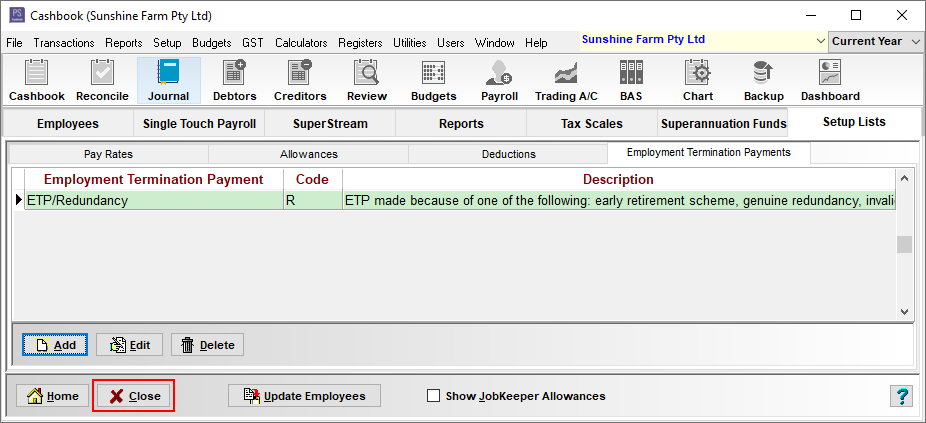

- Click on the Close button to exit.

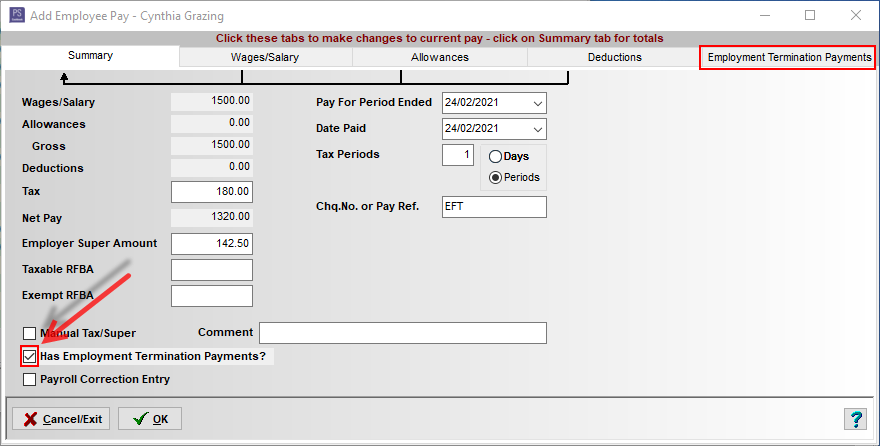

Add the ETP pay type to the employee's final pay:

- Click on Payroll toolbar icon.

- Click on the Employee tab.

- Click on the employee (e.g. Cynthia Grazing) to highlight.

- Click on Select Employee. (or simply double click on the employee)

- Click on the Add Pay button.

- Tick the Has Employment Termination Payments? box.

- This will bring up a new tab called Employment Termination Payments.

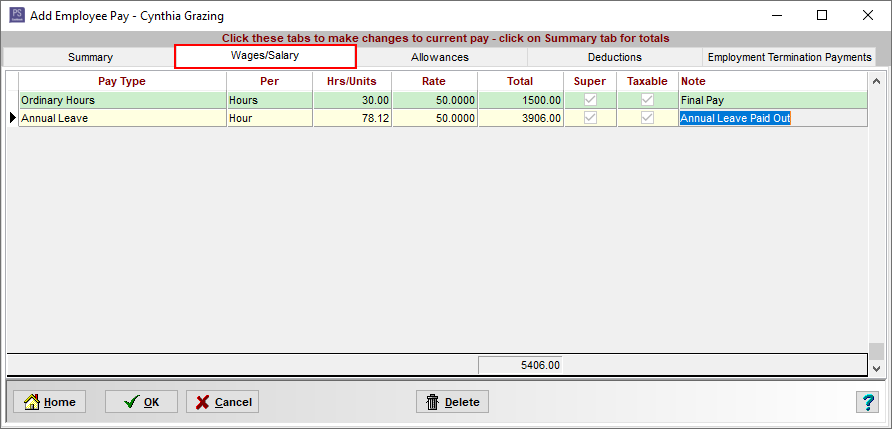

- Add your employees pay as per normal.

- If there is any Annual Leave to be paid, include as a separate dissection.

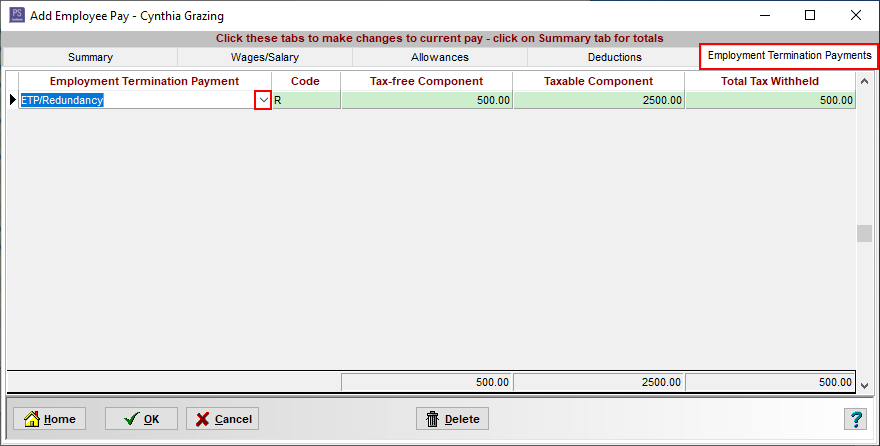

- Click on the Employment Termination Payment tab.

- Select the Employment Termination Payment pay type you have just created from the dropdown list. e.g. ETP/Redundancy

- This should auto-fill the Code. e.g. R

- Fill in the amounts for Tax-fee Component, Taxable Component and Total Tax Withheld. as per your accountants' advice.

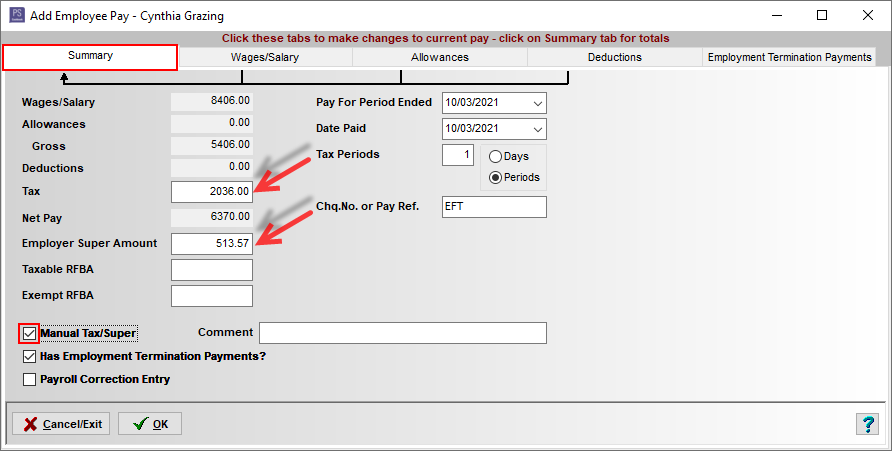

- Click on the Summary tab.

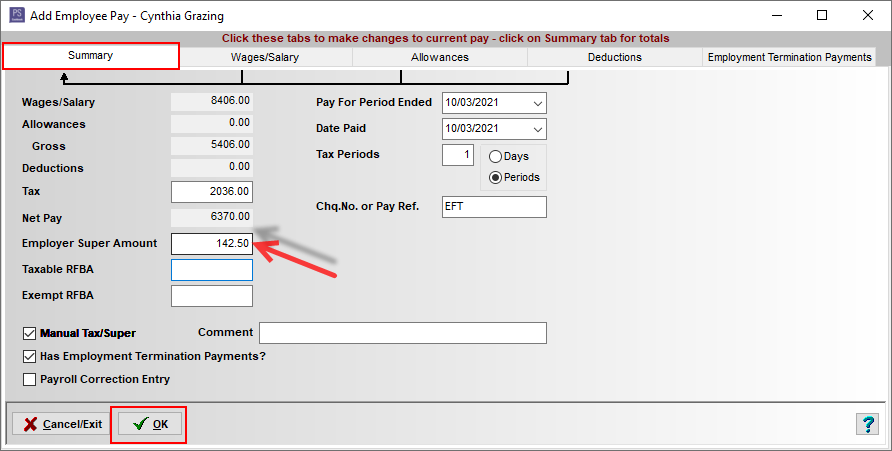

- IF the Tax or Employer Super Amount needs to be adjusted, tick on the Manual Tax/Super box and manually adjust in the respective text boxes.

E.g. According to the ATO, lump sum termination payments for unused annual leave, unused long service leave and unused sick leave are not part of an employee's ordinary time earnings (OTE). ... Therefore, none of these termination payments would attract super contributions.

- Or simply click the OK button to save.

- Click Yes to the Information message: 'Do you want to add this pay into your cashbook?'

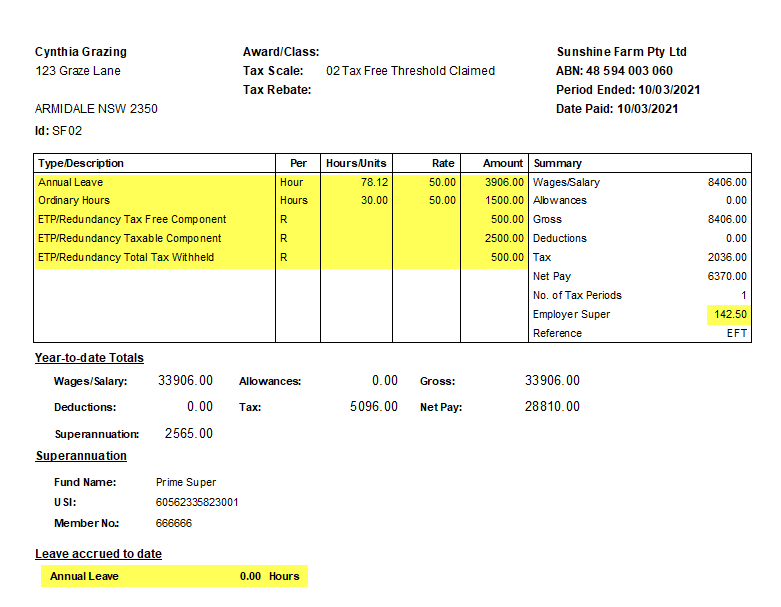

An example of the pay slip:

- Finally, complete the pay and STP submission to the ATO.

Teamviewer

Teamviewer