PS Cashbook

Revaluation of an Asset

Summary

How do I revalue an asset so it will be reflected on my Asset and Liabilities (Net Worth) Report?

Detailed Description

This is an advanced function that provides a simple means of changing values for assets and liabilities without the need for complicated journal entries - the system creates the entries for you.

This function is normally used to alter the current value of land, buildings, investments, etc.

- To revalue your assets and liabilities follow these instructions:

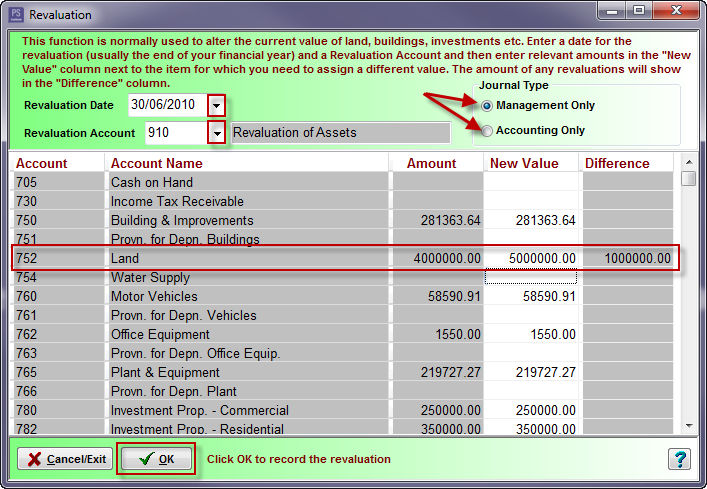

- Click on the Transactions > Revalutaion menu option.

- Enter a date for the revaluation (usually the end of your financial year).

- Choose an account (from the drop-down list) to receive the resulting revalution amount - this would normally be an equity type account such as Revaluation of Assets.

- Select Journal Type:

- Management Only.

- Accounting Only.

- The system will display a list of assets and liabilities (except banks, trading stock, GST clearing account and debtors/creditors countrol accounts) as at the nominated date in a tabular form - you may now enter any required revised values in the New Value column.

- The amount of the revaluation will display in the Difference column.

- Click on the OK button to process the revaluation.

- Click OK to the Information message: ' Revaluation journal entries processed.'

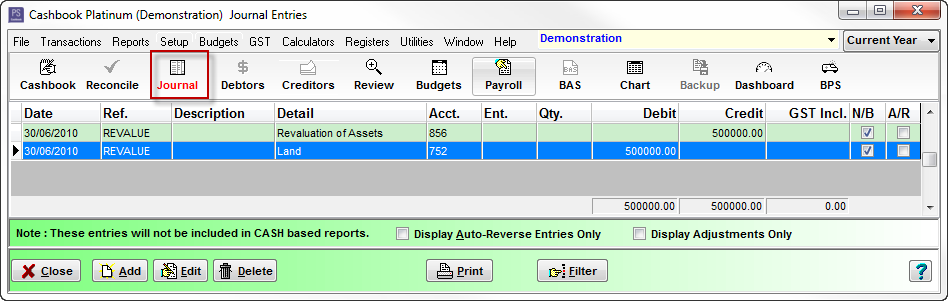

Click on the Journal toolbar option to see the journal entry created.

- Note: To see asset revaluation reflected on the Asset and Liabilities (Net Worth) Report you must run any report based on the same Journal Type selected. i.e. Management or Accounting.

- To reverse a revaluation, click on the Journal toolbar option and delete the relevant journal transactions.

Was this helpful?

Not helpful (

) Very helpful

Teamviewer

Teamviewer