PS Cashbook

Record Receipt of Loan & Repayments

Summary

How do I record the receipt of a loan and repayments?

Detailed Description

This article describes the basic recording of the receipt of a loan where the loan amount is received by you (i.e. money is not paid directly to creditor) and to record the loan repayments. Because there's lots of loan types, interest rates, terms and conditions, you might need help from your accounting advisor to determine the best way to set this up for your loan.

To accurately track your loan balance, you'll need to know:

- the initial loan amount

- the value of your repayments, and

- the repayment breakdown (how much of the repayment reduces the principal, and how much relates to interest charges).

Step 1: Setup Loan Accounts

- Set up the required loan accounts in the chart of accounts. For details on how to do this click here.

Step 2: Add Receipt of Intial Loan Amount

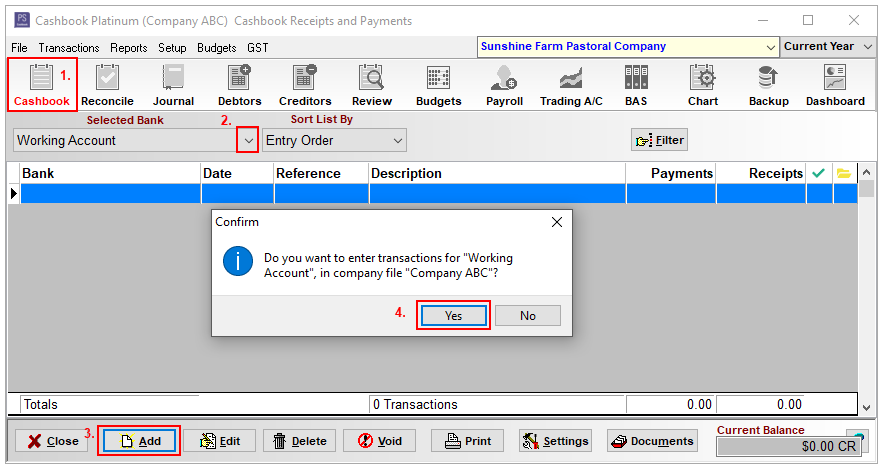

- Click on the Cashbook toolbar icon.

- Select the required bank.

- Click on the Add button.

- Click Yes to the Confirm message: 'Do you want to enter transactions for "Working Account", in company file "Company ABC"?'

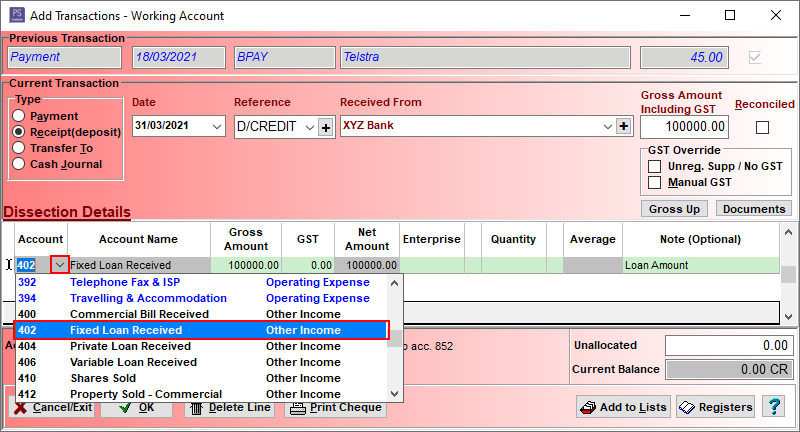

- Click on the Receipt (deposit) radio dial to select as transaction type.

- Date

- Reference - e.g. DEPOSIT or D/CREDIT

- Received From - e.g. bank or financial institution you have received the loan from.

- Gross Amount including GST - amount of loan

- Account - Select the account code from the drop down menu.

- Note (Optional)

- Click OK to save.

- Click on the Cancel/Exit button.

Step 3: Record a Loan Repayment.

Note: An amortization (or loan) schedule is a complete table or list of periodic loan payments, showing the amount of principal and the amount of interest that comprise each payment until the load is paid off at the end of its term. Each periodic payment is the same amount in the total for each period. However, early in the schedule, the majority of each payment is what is owed in interest, later in the schedule, the majority of each payment covers the loan's principal. - Ask lender for a Loan Repayment Schedule.

A. Setup Supplier with loan details.

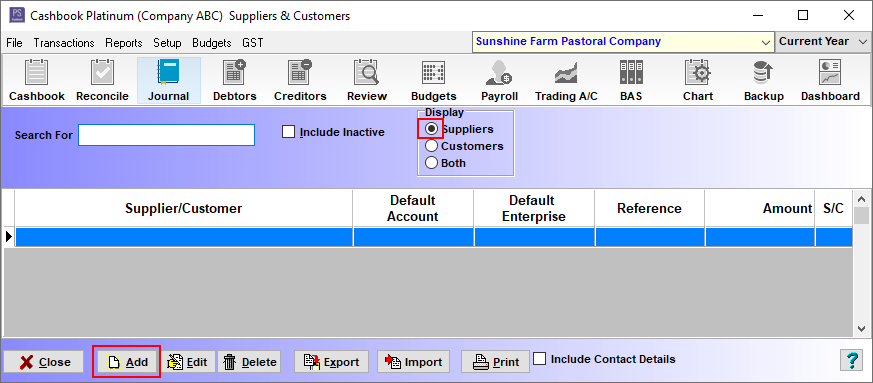

- Click on Setup > Suppliers and Customers menu options.

- Click on the Supplier radio dial.

- Click on the Add button.

- Name e.g. XYZ Bank. (Note: This bank was already setup as a Customer, put a full stop after the name to allow this same bank to be setup as a Supplier)

- ABN

- Click on the Multiple dissction lines radio dial.

- Reference: D/DEBIT (i.e. Direct Debit - money is taken out of your bank account automatically).

- Amount e.g. $1500 (the amount of your monthly, quarterly etc. loan repayment).

- Account, Enterprise (if applicable), Value Type, Note dissection line for both Principal and Interest. (The principal and interest amounts will vary with each payment)

- Click OK to save.

B. Add repayment transaction to Cashbook.

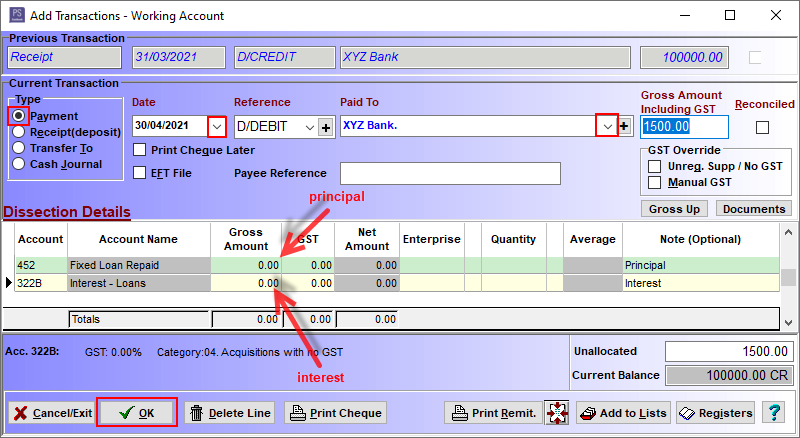

- Click on the Cashbook toolbar icon.

- Select the required bank.

- Click on the Add button.

- Click Yes to the Confirm message: 'Do you want to enter transactions for "Working Account", in company file "Compay ABC"?'

- Click on the Payment radio dial to select as transaction type.

- Date

- Paid To - e.g. select XYZ Bank. from the drop-down list.

- All information from supplier setup will auto-fill.

- Enter the amount of prinicipal and the amount of interest in each dissection link. (see Loan Repayment schedule or accountant)

- Click OK to save.

- Click on the Cancel/Exit button.

Teamviewer

Teamviewer