PS Cashbook

Credit Notes

Summary

How do I add customer invoice credit note (credit note adjustment)?

Detailed Description

- A credit note is a document sent by a seller to the customer (vendor to a purchaser), notifiying that a credit has been made to their account.

- A credit note may be issued because:

- a customer returned the goods or rejected the services for any number of reasons.

- the goods were damaged in some way.

- there was a mistake in the price on the original invoice.

- the customer overpaid the original invoice.

- A credit note is created in a very similar format to Customer Invoices, except it reduces that amount owed to you by a customer, or that you owe to a supplier. i.e. A credit note (credit adjustment note) is effectively a negative invoice.

- A credit note is raised against a customer or supplier, allowing the customer or supplier to be held in credit until a future invoice is raised.

To add a customer invoice credit or adjustment follow these instructions:

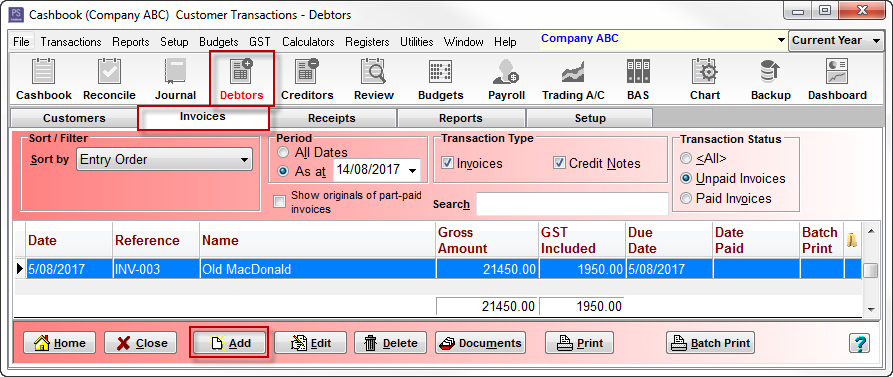

- Click on the Debtors toolbar icon.

- Click on the Invoices tab.

- Click on the Add button.

For this example: Old MacDonald purchased 30 weaner steers but only 26 weaners could fit on the truck. We are giving Old MacDonald a Credit Note (refund) for the 4 weaner steers he did not receive.

- Select the Customer you're giving credit to from the drop-down menu.

- Date - select.

- Form - select from drop-down menu. e.g. Credit Note.

- Ref. - create a reference number. (e.g. original invoice number was INV-003, credit note relating to that invoice CN-003).

- Add Account, Enterprise (if applicable).

- Enter amounts for credit as negative amounts. i.e. put a minus sign in front of the amount.

- Click the Print button to preview the whole credit and then click on the printer icon if required.

- Click OK to save.

How original invoice and credit note appear in the list of Unpaid Invoices:

How to apply a credit note to a payment:

- Click on the Cashbook toolbar icon.

- Click on the Add button.

- Click Yes to the Confirm message: 'Do you want to enter transactions for "Working Account", in company file "Company ABC"?'

- Click on the Receipt (deposit) radio dial.

- Date - click on drop-down arrow to select date from calendar.

- Reference - e.g. DEPOSIT, D/CREDIT.

- Click on the Invoice button.

- In the Current Debtor Invoices window, tick the check box in the P colum next to the applicable customer Name.

- Adjust Amt.Paid accordingly if the amount differs from the actual amount paid.

- Click OK button.

- Invoice information automatically fills dissections of the Add Transactions window:

- Click on the OK button to save.

Click on the following link for Recording an advance payment from a customer. (i.e. Creating a Credit Note to apply to a future invoice yet to be generated.)

Teamviewer

Teamviewer