PS Cashbook

Invoices that will never be paid

Summary

How do I write off invoices that will never be paid?

Detailed Description

You can only claim a bad debt deduction for amounts you have included in your assessable income, either in your tax return for the year you claim the deduction or in an earlier income year.

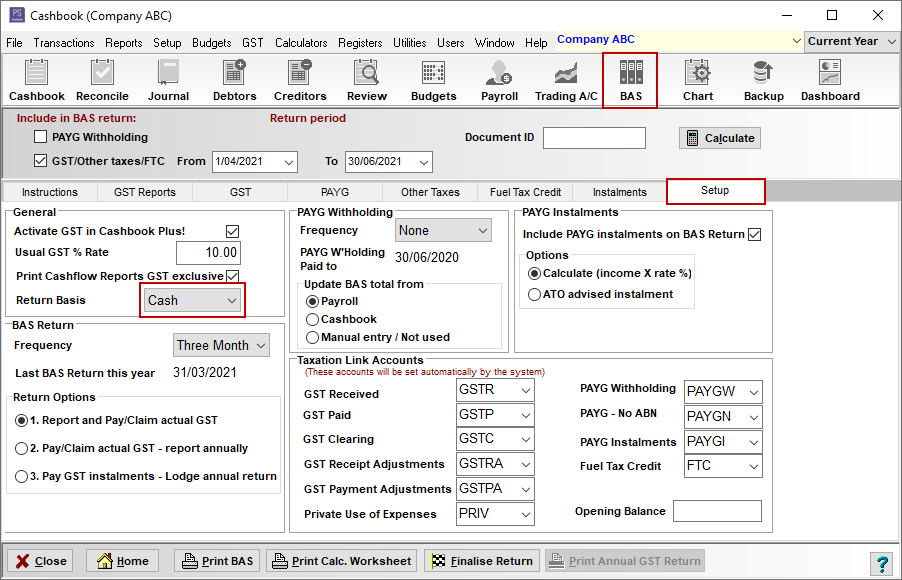

Step 1: Determine if you are operating on a Cash or Accrual basis.

- Click on the BAS toolbar option.

- Click on the Setup tab.

- In General box, see if the Return Basis is on Cash or Accrual.

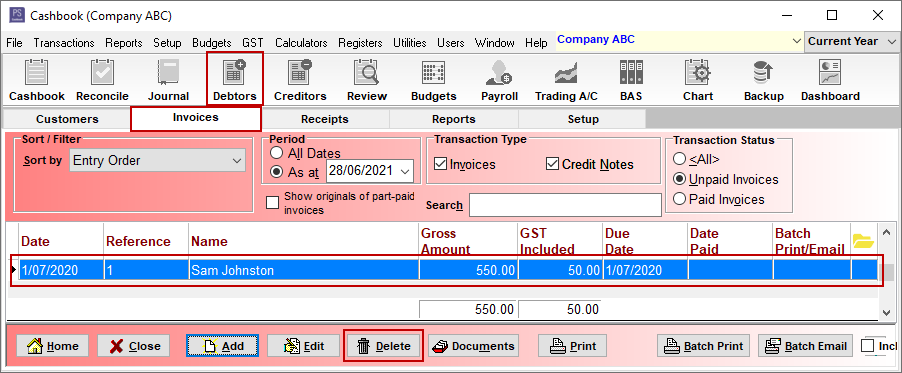

Step 2a: If you calculate the BAS on a Cash basis then you can:

- Click on the Debtors toolbar option.

- Click on the Invoice tab.

- Click on the invoice you wish to delete, so it is highlighted.

- Click on the Delete button.

Step 2b: If you calculate the BAS on an Accrual basis then you need to:

When a specific invoice is actually written off, this is done by creating a credit note in the accounting software that specifically offsets the targeted invoice.

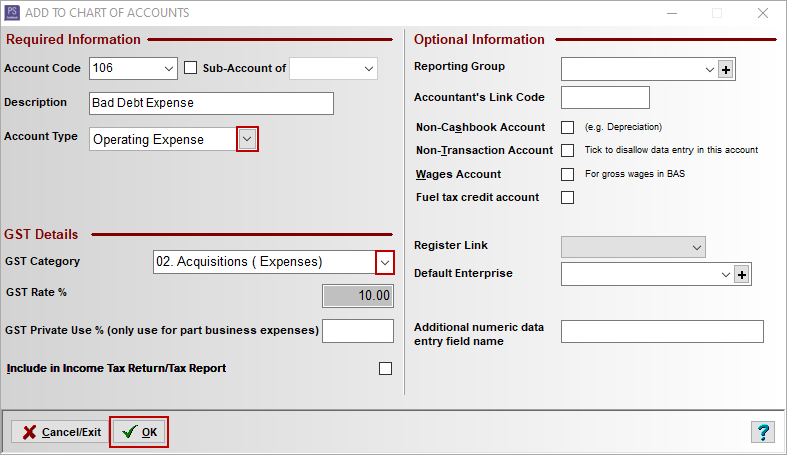

1. Create a Bad Debts Account Code

- Click on the Chart toolbar icon.

- Click on the Expenses tab.

- Click on the Add button.

- In the ADD TO CHART OF ACCOUNTS window:

- Select an Account Code that is not already being used

- Add a Description, eg. Bad Debts

- Account Type: Operating Expense

- GST Category: 02. Acquisition (Expenses)

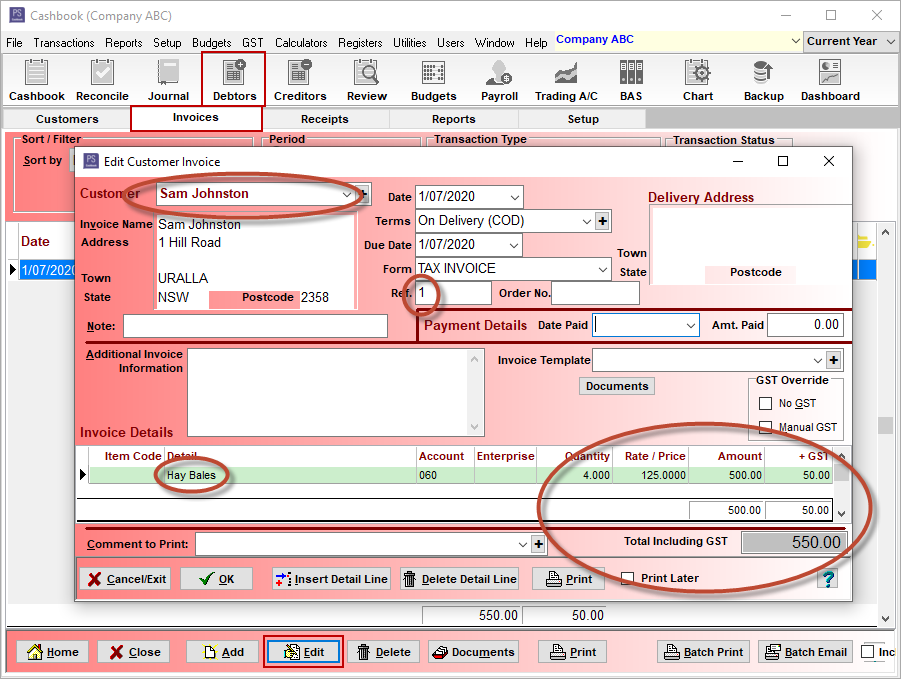

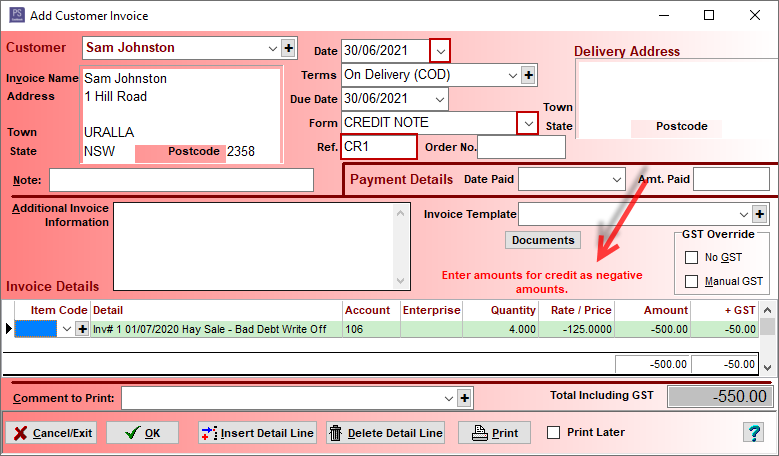

2. Enter a Credit Note using the Bad Debts Account Code.

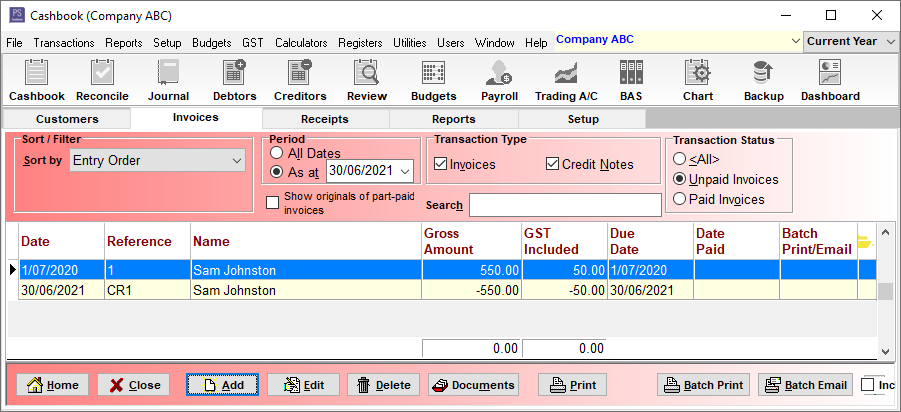

- Click on the Debtors toolbar icon.

- Click on the Invoices tab.

- Find the invoice that will never be paid. Edit it and make note of the invoice details.

- Click on the Cancel/Exit button when done.

For example:

- Click on the Add button.

- Customer - select the Customer with the bad debt to be written off.

- Date - date has to be in the current BAS period.

- Form - select Credit Note from the drop-down menu.

- Ref. - e.g. CR1

- In the dissection line select the account code for Bad Debts and enter the amount as a negative.

- Click on the OK button to save.

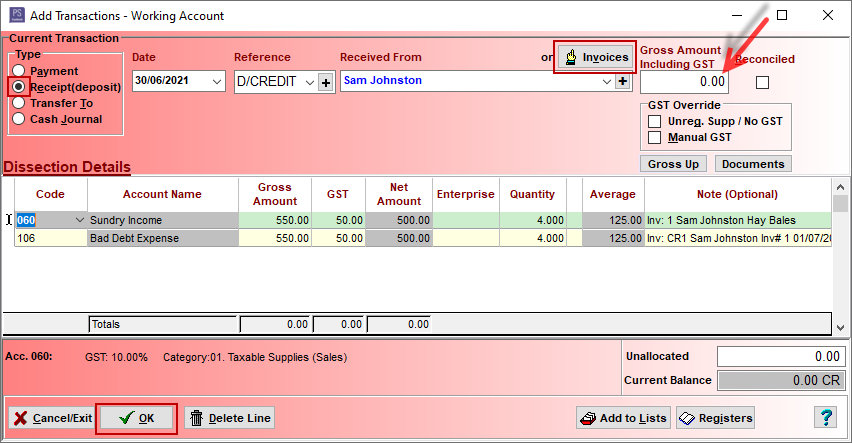

- Click on the Cashbook toolbar icon.

- Click on the Add button.

- Type - Receipt (deposit)

- Date - date has to be in the current BAS period

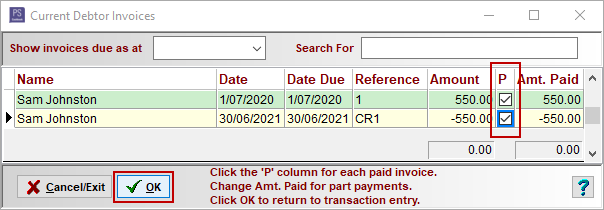

- Click on the Invoice button.

- Tick the original invoice and the credit note.

- Click OK to return to transaction entry.

- Gross amount of transaction is $0.00. (essentially a cash journal)

- Click OK to save.

For example:

Teamviewer

Teamviewer