PS Cashbook

Budgets - Loan Account Setup

Summary

How do I enter loans into my budget?

Detailed Description

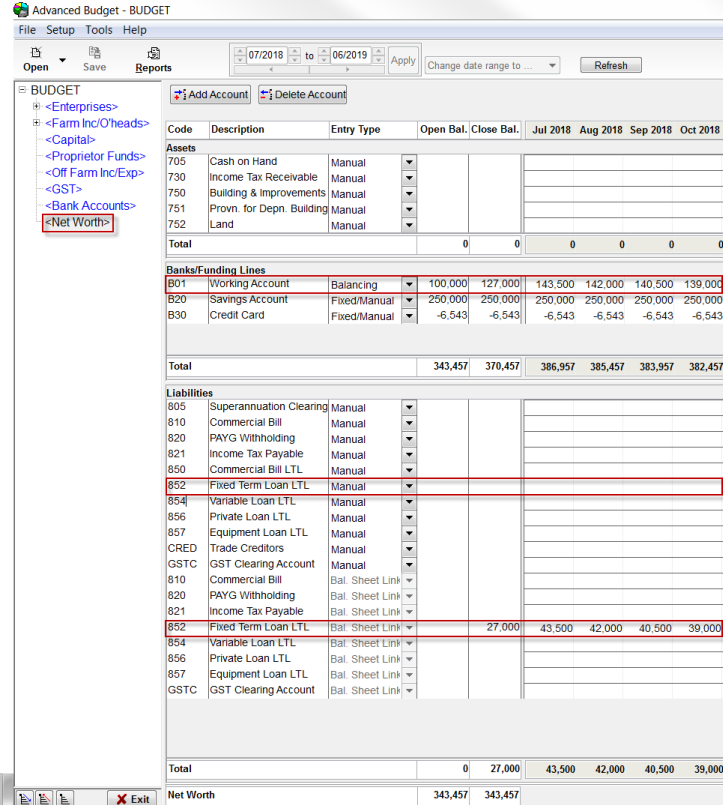

The Net Worth section is used to budget Assets and Liabilities to give a monthly budgeted net worth position over the budget period. It is laid out in three parts: Assets, Banking/Funding Lines (which may be in credit or overdrawn) and Liabilities.

Where "Balance Sheet Link" accounts are present, there may also be another line for the same account. This is used for the opening balance for this account and any manual adjustments - for example, loan accounts. When the Net Worth Budget is printed, any "duplicate" lines will be added together and show as one total line for that account.

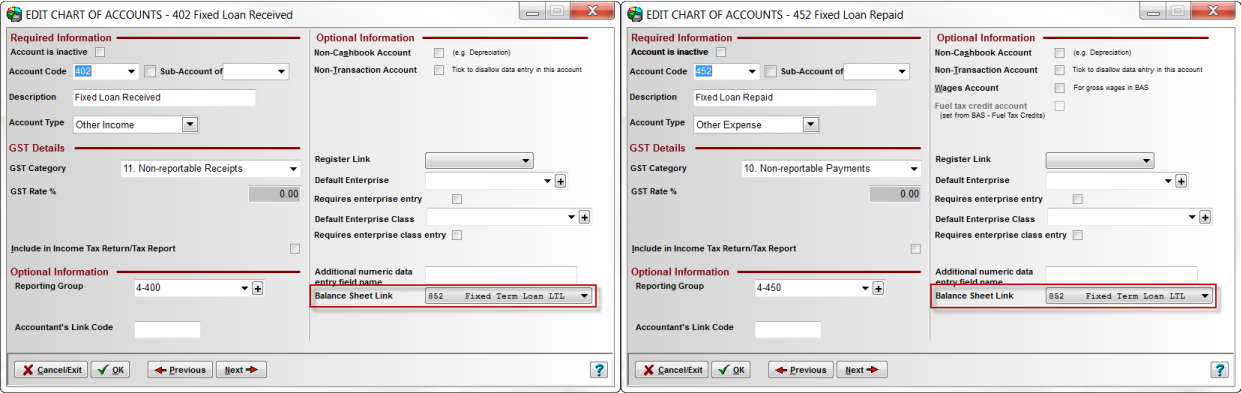

Note: A Balance Sheet Link Account in Chart is an Other Income or an Other Expense account. The Balance Sheet Link option in the Chart of Accounts allows you to link these accounts to corresponding Balance Sheet account (i.e. Assets, Liability or Equity accounts). For e.g. Loan Repayments (Other Expense) might be linked to the Loan Account (Liability)

To illustrate how these accounts work within the budget, we'll use the example of a business purchasing a vehicle for $45,000 fully finance. Repayments are $1500 per month.

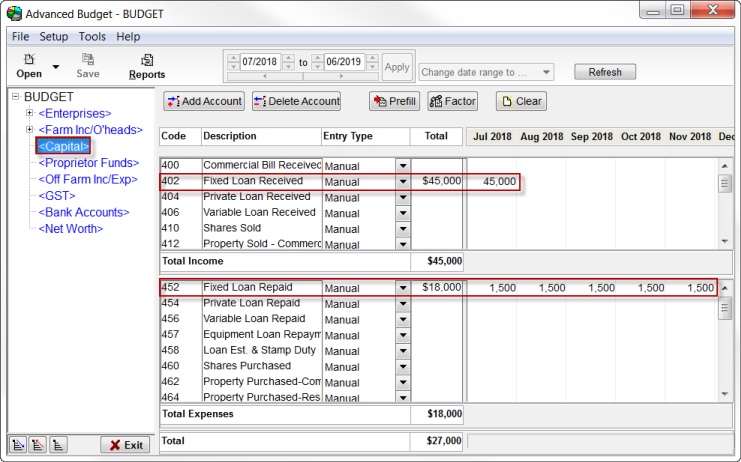

- Click on <Capital>

- The actual Loan Received amount (i.e. the total amount borrowed) is entered in the Income section in the respective month. For this example the amount borrowed for the purchase of the vehicle was $45,000 in July 2018.

- The Loan Repaid (repayments amounts) are entered in the Expenses section. For this example the business makes loan repayments of $1500 each month.

- The Fixed Loan Received and the Fixed Loan Repaid accounts are both Balance Sheet Link accounts. i.e. they are both linked to the Liability account - Fixed Term Loan LTL. Any amounts enter into either the Fixed Loan Received or Repaid accounts will effect the Fixed Term Loan account.

Again: A Balance Sheet Link Account in Chart is an Other Income or an Other Expense account. The Balance Sheet Link option in the Chart of Accounts allows you to link these accounts to corresponding Balance Sheet account (i.e. Assets, Liability or Equity accounts). For e.g. Loan Repayments (Other Expense) might be linked to the Loan Account (Liability).

- Click on the <Net Worth>

- Again: where "Balance Sheet Link" accounts are present, there may also be another line for the same account. This is used for the opening balances for this account and any manual adjustments. Where the Net Worth Budget is printed, any "duplicate" lines will be added together and show as one total line for that account.

- 852 Fixed Tern Loan LTL (Bal. Sheet Link) shows the balance of this account per month. e.g. July 2018 Amount Financed - Less Repayment $45,000-$1,500=$43,500.

- 852 Fixed Term Loan LTL (Manual) - any manual adjustments would be added here. Or if this was an existing loan, the opening balance would be entered here.

- B01 Working Account (Balancing) - note that the balancing bank account is also affected by any amounts entered in the various income and expense sections of the budget.

Teamviewer

Teamviewer