PS Cashbook

Write Off Bad Debt

Summary

How do I write of a bad debt (unpaid debtor invoice)?

Detailed Description

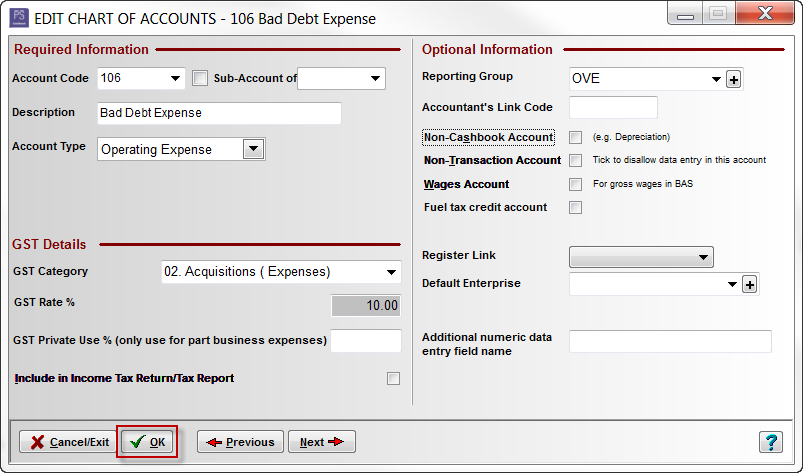

Create a Bad Debt Expenses account in Chart:

- Click on the Chart toolbar icon.

- Click on the Expenses tab.

- Click on the Add button.

For example:

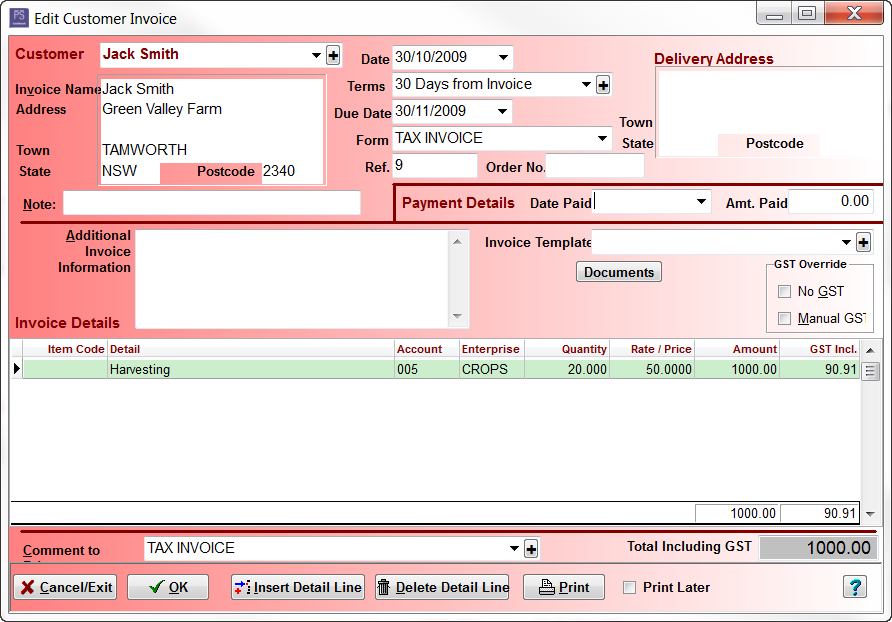

- Click on the Debtors toolbar icon.

- Click on the Invoices tab.

- Edit the invoice that is to be written off as a bad debt and make note of the details.

- Amount of invoice still unpaid.

For example:

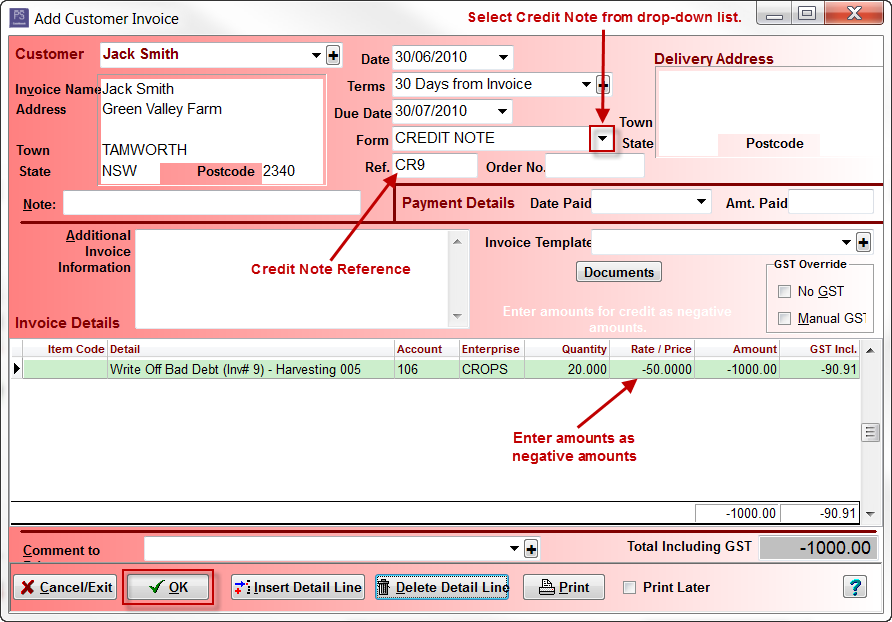

- Cancel/Exit out of invoice.

- Click on the Add button.

- Customer - e.g. Jack Smith (as above)

- Date - e.g. today's date (not the date of the original invoice).

- Form - select CREDIT NOTE from the drop-down list.

- Ref. - e.g. CR9

- Detail - Write Off Bad Debt (Inv# 9) - Harvesting 005

- Account - 106 Bad Debt Expenses (the account you created in Step 1)

- Enterprise - (if applicable)

- Quantity, Rate/Price, Amount - enter these exactly the same as orginal invoice but entered as a negative.

- Click OK button to save.

For example:

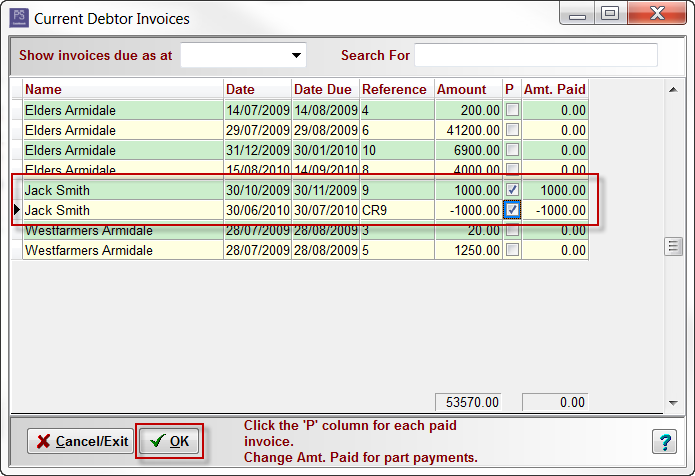

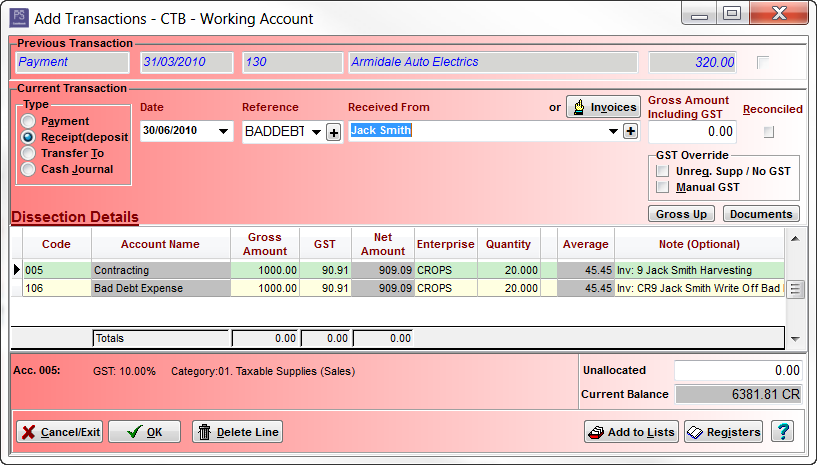

- Click on the Cashbook toolbar icon.

- Click on the Add button.

- Choose Type - Receipt (deposit).

- Click on the Invoices button.

- Tick the original invoice and the matching credit note in the P column.

- Click OK to return to the Add Transactions window.

- Click on the OK button to save.

Was this helpful?

Not helpful (

) Very helpful

Teamviewer

Teamviewer