PS Cashbook

Recording JobKeeper Allowances

Detailed Description

Once you have enrolled for the JobKeeper payment, and you can identify and report your eligible employees though Cashbook's Single Touch Payroll reporting.

Important Information: Cashbook cannot be used for Step 1 (Enrolling for the JobKeeper payment) or Step 3 (Making a monthly business declaration) of the JobKeeper process. Please ensure you are familiar with the rules and your obligations relating to the JobKeeper payment, which can be found at https://www.ato.gov.au/General/JobKeeper-Payment/Employers/Enrol-for-the-JobKeeper-payment

ATO Information

General information relating to JobKeeper payments: https://www.ato.gov.au/General/JobKeeper-Payment/

Information on the extensions to the JobKeeper Payment: https://www.ato.gov.au/General/JobKeeper-Payment/JobKeeper-extension-announcement/#extension1

Please make yourself familiar with this official information, then continue reading below.

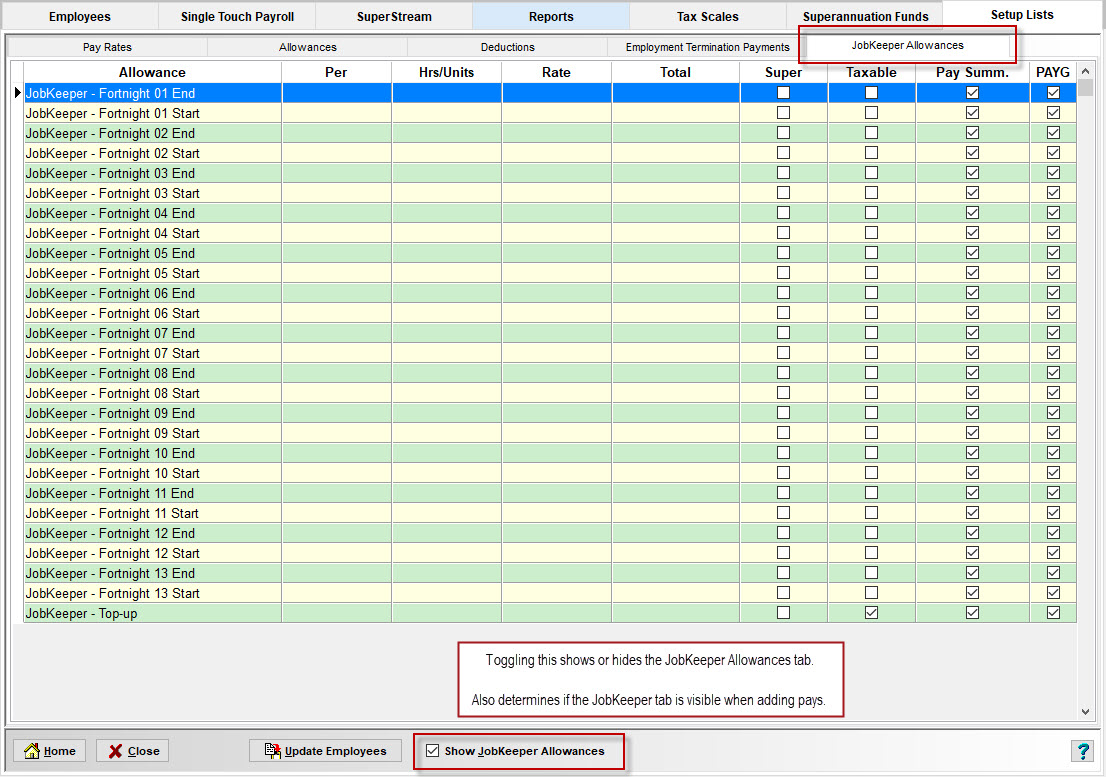

The JobKeeper Allowances

The JobKeeper allowances can be found in the Setup Lists section of Payroll. The will be automatically enabled but can be disabled if you are not claiming the JobKeeper payment for any of your employees.

Important Information: You cannot create your own rates as they will not be reported correctly. If you are claiming the JobKeeper payment for any employees, you must use the rates below.

The list of JobKeeper Allowances in Cashbook have "friendly" names for ease of reading. They will be converted to the required ATO codes when you report through Single Touch Payroll (i.e. The Cashbook allowance JobKeeper - Top-up will be converted to JOBKEEPER-TOPUP automatically).

Identifying Employees

Please see here for which fortnight number to use: https://www.ato.gov.au/General/JobKeeper-Payment/JobKeeper-key-dates/#JobKeeperfortnights

Indentify eligible employees

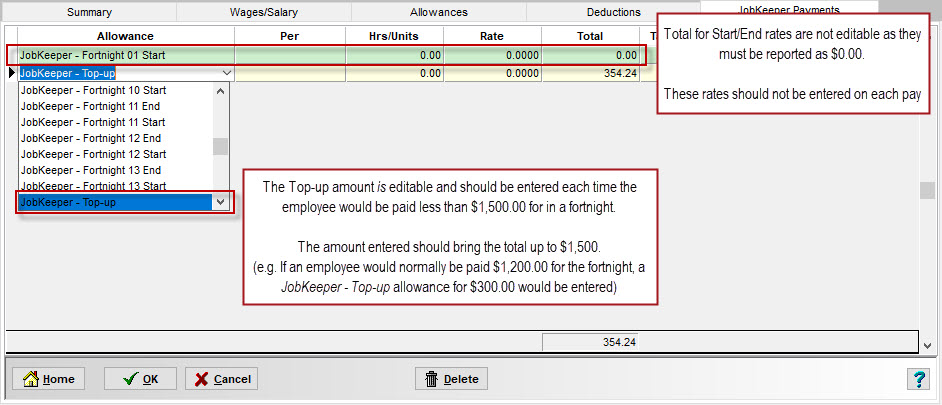

Employees are identified when you report them through Single Touch Payroll, by including the appropriate JobKeeper - Fortnight Start allowance. This must be done for all eligible employees.

Indentify Tier

During the JobKeeper Extension 1 & 2 periods, you need to identify which Tier of JobKeeper payments an employee is eligible for. Do this by including a JobKeeper - Tier 1 or JobKeeper - Tier 2 allowance. If you report the incorrect tier you can simply replace it with the correct tier, or you can report the applicable JobKeeper - Tier X (Cancel) allowance along with the correct tier.

Indicating exit of eligibility

To indicate any exit of eligibility or termination of the employee, add the JobKeeper - Fortnight End allowance for first fortnightly period to which the payment no longer applies.

These start and end amounts will be reported as zero.

Recording Payments to Employees

Employees who are paid less than the applicable jobkeeper amount (see the above information relating to tiers and extension periods) must have a "top-up" amount included to bring their taxable gross up to the amount for the relevant tier.

E.g., an employee in extension 1 who is paid less than $900 per fortnight would need to include a $300 top-up allowance to bring their taxable gross to the Tier 1 payment amount of $1,200

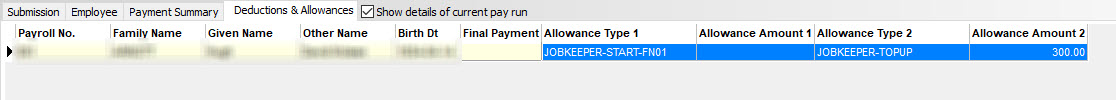

Reporting through Single Touch Payroll

The JobKeeper allowances will appear in the Deductions & Allowances tab of Single Touch Payroll (see below).

Teamviewer

Teamviewer