PS Cashbook

Pay Advance/Employee Loan

Summary

How to account for a pay advance to an employee?

Detailed Description

The following steps will guide you through setting up Cashbook for recording pay advances.

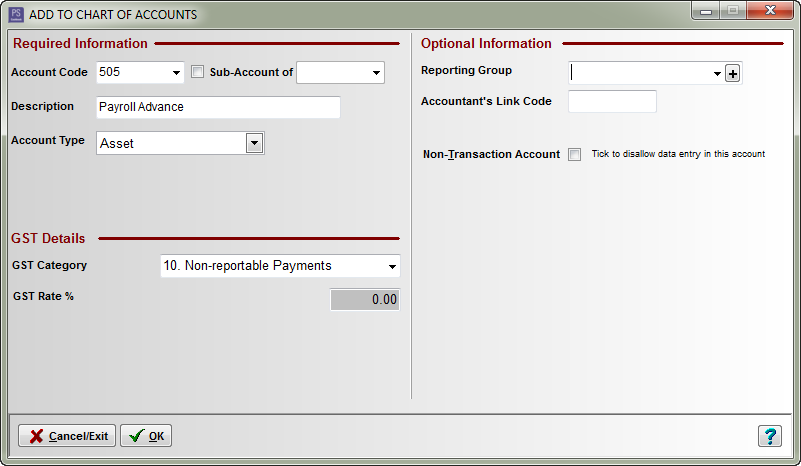

Step 1. Create an Asset account

- Click on the Chart toolbar icon.

- Click on the Assets tab.

- Click on the Add button.

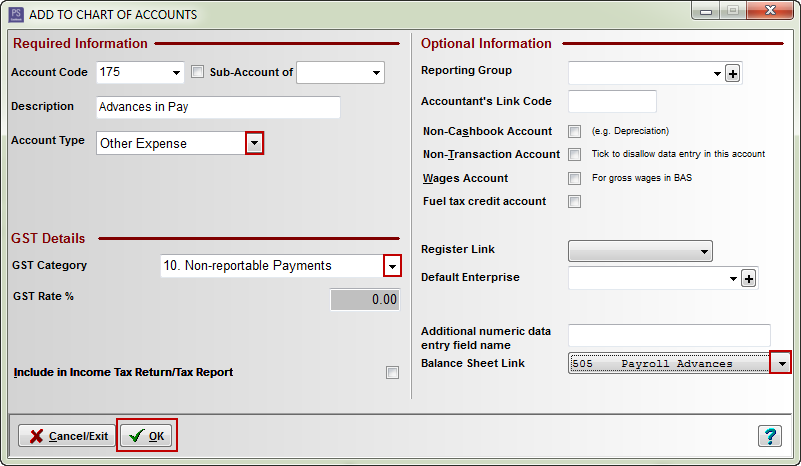

Step 2. Create an Advances in Pay account

This account will be used when you pay an advance on the employee's pay/wages.

- Click on the Chart toolbar icon.

- Click on the Expenses tab.

- Click on the Add button.

- Add details for new other expense account Advances in Pay (see below):

- Account Type: Other Expense

- GST Category: 10. Non-reportable Payments

- Balance Sheet Link: 505 Payroll Advances

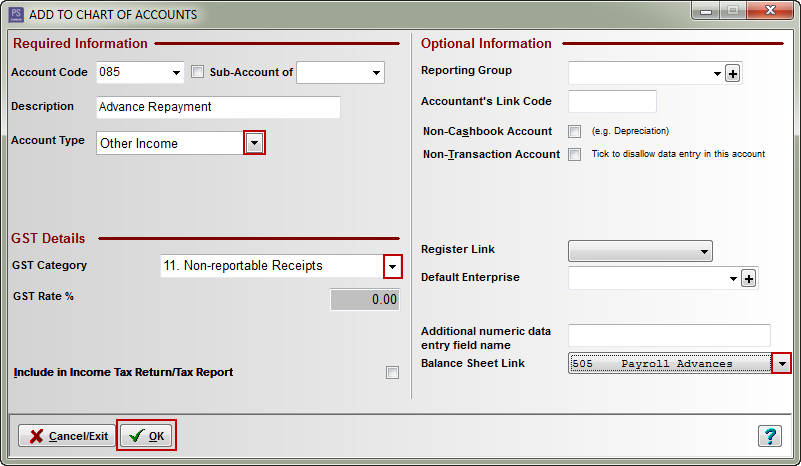

Step 3. Create an Advance Repayment account

This account will be use to withhold the advance from the employee's future pay.

- Click on the Chart toolbar icon.

- Click on the Income tab.

- Click on the Add button.

- Add details for new other expense account Advances in Pay (see below):

- Account Type: Other Income

- GST Category: 11. Non-reportable Receipts

- Balance Sheet Link: 505 Payroll Advances

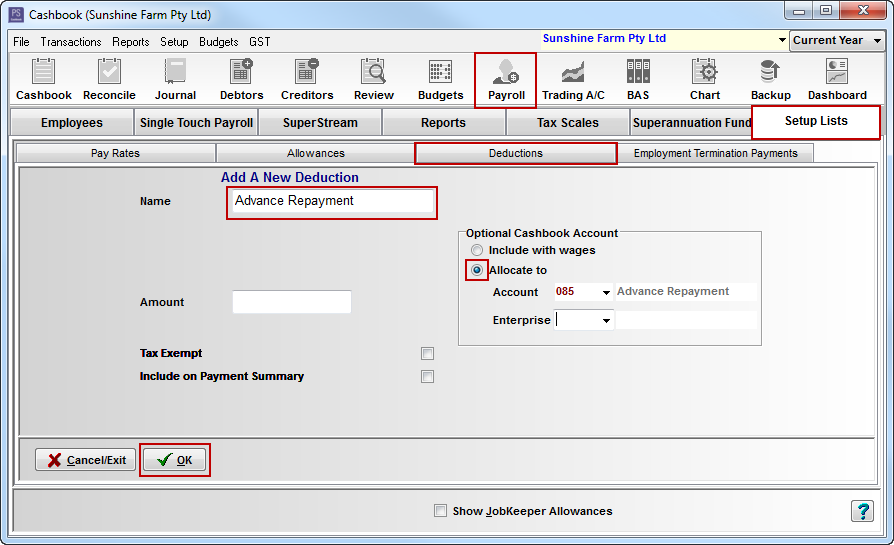

Step 4. Create an Advance Repayment deduction in Payroll

This deduction will be used to record the repayment of an advance in the employee's wages

- Click on the Payroll toolbar icon.

- Click on the Setup Lists tab.

- Click on the Deductions tab.

- Click on the Add button.

- Enter as follows:

- Name e.g. Advance Repayment

- In the Optional Cashbook Account box:

- Tick the Allocate to radio dial.

- Select Account e.g. 085 Advance Repayment

- Click OK to save.

Example Use

A shearer Daniel Brown does not get paid until the end of the week but he has asked his employer for an advance in his wages of $200.

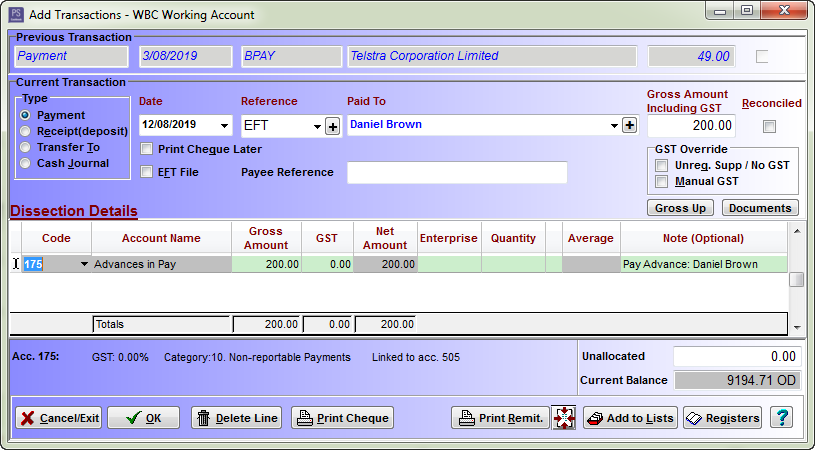

Step 1: Recording an advance in pay

- Click on the Cashbook icon.

- Click on the Add button.

- Enter the payment transaction.

- Type - Payment

- Gross Amount - 200.00

- Code - 175 Advances in Pay

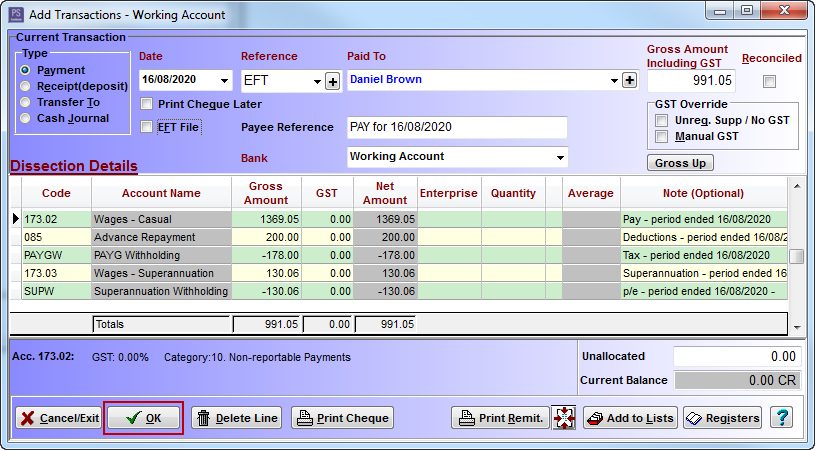

Step 2. Deducting the advance from a wage payment

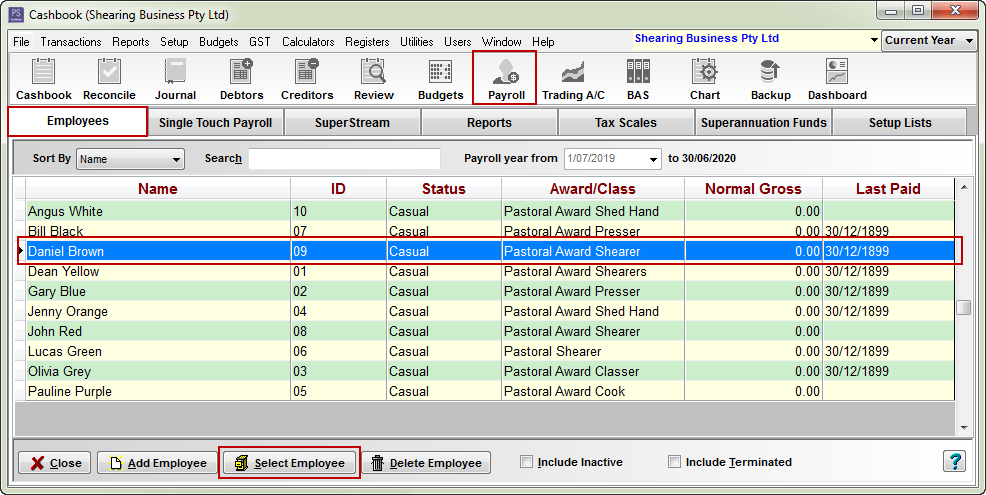

- Click on the Payroll icon.

- Double-click on the employee

- Click on the Add Pay button.

- Make sure Pay For Period Ended and Date Paid is corrrect.

- Click on the Wages/Salary tab.

- Enter pay information as you would normally. e.g number of hours, rate, allowances etc.

- Click on OK button.

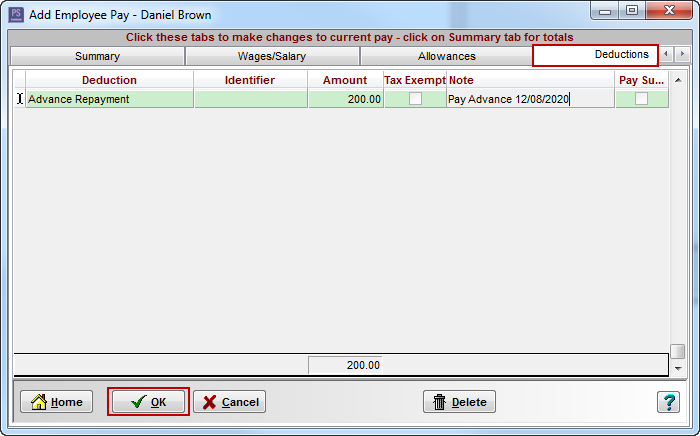

- Click on the Deductions tab.

- Fill in window as follows:

- Deduction e.g. Advance Repayment

- Amount e.g $200 (this is the amount of the advance you have paid your employee)

- Note optional

- Click OK to save.

Teamviewer

Teamviewer