PS Cashbook

Unpaid Leave - Adjustment to Leave Accrual

Summary

How do I adjust Annual and Sick Leave when an employee is on unpaid leave?

Detailed Description

An employee absent on leave without pay does not accrue annual leave during that period of absence. As with annual leave, sick leave does not continue to accrue while an employee is on unpaid leave.

The accrual of leave in Cashbook only works on time period and assumes that the acrrual applies for the relevant period, so you will need to calculate the accrual amount that should not have happened and put in an adustment.

The National Employment Standards speicfy that as a minimum, full-time and part-time employees get 4 weeks of annual leave, based on their ordinary hours of work. Also, the minimum personal leave entitlement is 10 days per year for full-time employees, or pro rata of 10 days for part-time employees, depending on their hours of work.

If your employees are entitle to 4 weeks of annual leave per year (or pro-rata for part-time employees), the percentage to use is 7.6923%

If your employees are entitled to 10 days of personal leave per year (or pro-rata for part-time employees), the percentage to use is 3.84615%.

To calculate the percentage for 20 days (4 weeks) annual leave per year:

For example: An employee works 40 hours per 5-day week (8 hours per day) and they are entitled to 20 days (4 weeks) annual leave per year.

- The entitlement percentage formula is - (Total annual entitlement hours/Total annual work hours) x100 = %

- Total annual entitlement hours = 20 days x 8 hours per day = 160 hours

- Total annual work hours = 40 hours per week x 52 weeks = 2080 hours

- Entitlement percentage = (160/2080) x 100 = 7.6923%

Therefore, if an employee is entitled to 20 days annual leave per year, the percentage to use in their entitlement calculation is 7.6923%. This means that for every hour the employee works, they will accrue 0.076923 hours of annual leave.

For example: An employee works 40 hours per 5-day week (8 hours per day) and they are entitled to 10 days personal leave per year.

- The entitlement percentage formula is - (Total annual entitlement hours/Total annual work hours) x100 = %

- Total annual entitlement hours = 10 days x 8 hours per day = 80 hours

- Total annual work hours = 40 hours per week x 52 weeks = 2080 hours

- Entitlement percentage = (80/2080) x 100 = 3.8461%

Therefore, if an employee is entitled to 10 days personal leave per year, the percentage to use in their entitlement calculation is 3.8461%. This means that for every hour the employee works, they will accrue 0.038461 hours of personal leave.

To calculate the percentage rate for less than 20 days (4 weeks) annual leave per year: Example - 8 days personal leave entitlement

For example: An employee works 38 hours per 5-day week (7.6 hours per day) and they are entitled to 8 days personal leave per year.

The entitlement percentage formula is - (Total annual entitlement hours/Total annual work hours) x100 = %

- Total annual entitlement hours = 8 days x 7.6 hours per day = 60.8 hours

- Total annual work hours = 38 hours per week x 52 weeks = 1976 hours

- Entitlement percentage = (60.8/1976) x 100 = 3.0769%

Therefore, if an employee is entitled to 8 days personal leave per year, the percentage to use in their entitlement calculation is 3.0769. This means that for every hour the employee works, they will accrue 0.030769 hours of personal leave.

How to make adjustment in Cashbook:

Example: Bill Farmer works 40 hours per 5 day week (8 hours per day) and entitled to 20 days annual leave and 10 days personal leave per year. Bill gets paid fortnightly but is taking 1 week (5 days) of unpaid leave.

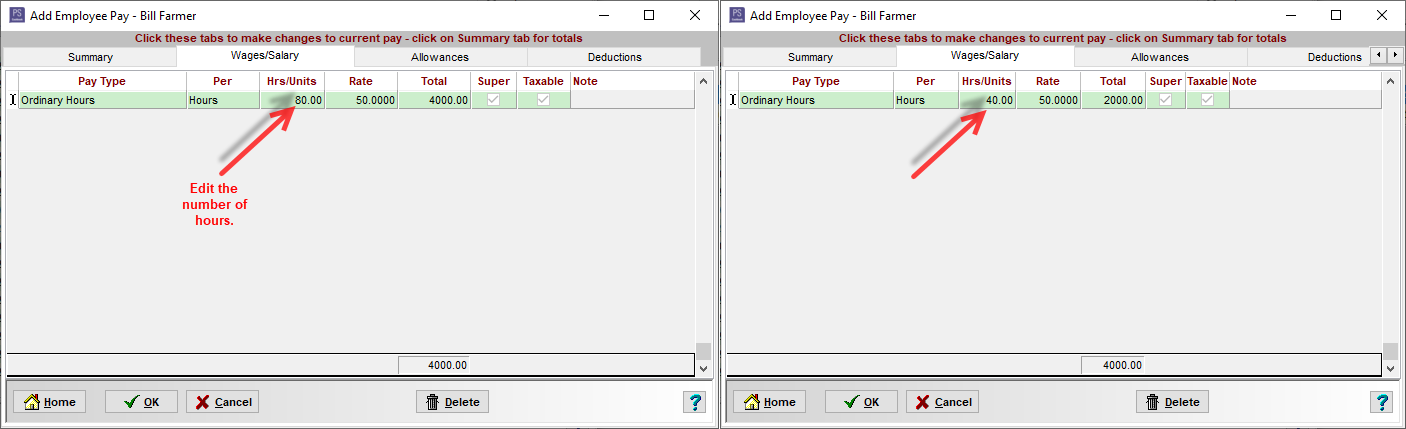

Step 1: Add pay to Cashbook.

- Click on Payroll toolbar icon.

- Click on Employees tab.

- Click on the employee (e.g. Bill Farmer) to highlight.

- Click on the Select Employee button. (or similarly, double click on the employee)

- Click on Add Pay button.

- Click on the Wages/Salary tab.

- Adjust the number of Hrs/Units.

- Click on the OK button to save.

- Click Yes to Information message: 'Do you want to add this pay into your cashbook?'

- Click OK to save the transactions.

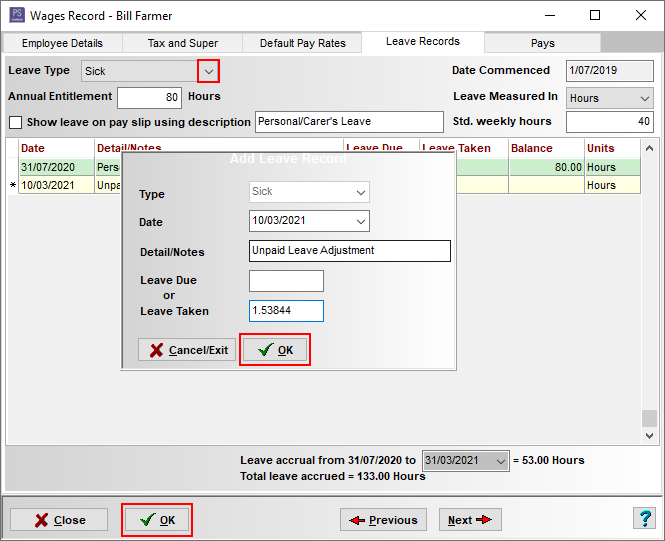

Step 2: Add Leave Accrual Adjustment for leave not accrued on Unpaid Leave:

- Click on the Leave Records tab.

- Select Leave Type Annual from the drop-down list.

Bill is entitled to 20 days holiday leave per year, the percentage to use in his entitlement calculation is 7.6923%. This means that for every hour the employee works, Bill will accrue 0.076923 hours of holiday leave. 40 hours x 0.076923 = 3.07692

- Click on the Add button.

- Enter Date e.g. 10/03/2021

- Enter Details/ Notes e.g. Unpaid Leave Adjustment

- Enter Leave Taken e.g. 3.07692

- Click OK to save.

- Select Leave Type Annual from the drop-down list.

Bill is entitled to 10 days personal leave per year, the percentage to use in his entitlement calculation is 3.8461%. This means that for every hour the employee works, Bill will accrue 0.038461 hours of personal leave. 40 hours x 0.038461 = 1.53844

- Click on the Add button.

- Enter Date e.g. 10/03/2021

- Enter Details/ Notes e.g. Unpaid Leave Adjustment

- Enter Leave Taken e.g. 1.53844

- Click OK to save.

- Click OK to save and exit.

Teamviewer

Teamviewer