PS Cashbook

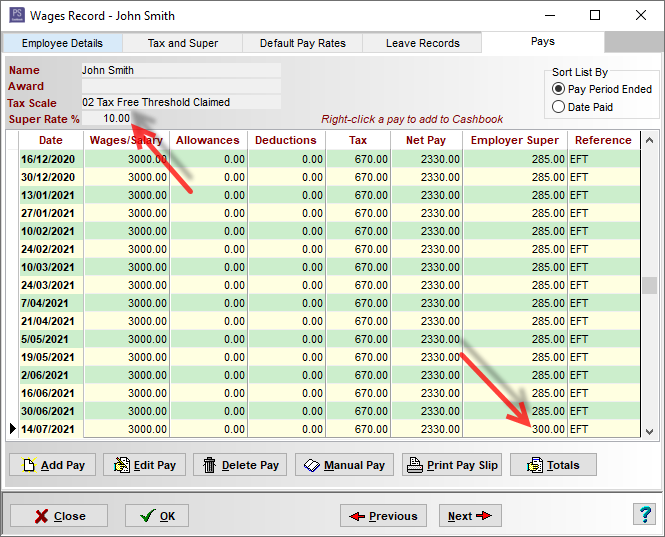

Update Superannuation Rate as at 01 July 2021

Summary

The super guarantee rate will increase from the current 9.5% p.a. to 10% p.a. as of 1 July 2021.

Detailed Description

The super guarantee rate will increase from the current 9.5% p.a. to 10% p.a. as of 1 July 2021.

*** Note: You will need to update this rate for each of your employees only once all pays to 30/06/2021 are completed.

*** Note: Any pays paid after 30/06/2021 will need to include the 10% on the whole pay regardless of what period the pay relates to.

A. To update the SGC superannuation rate for an employee:

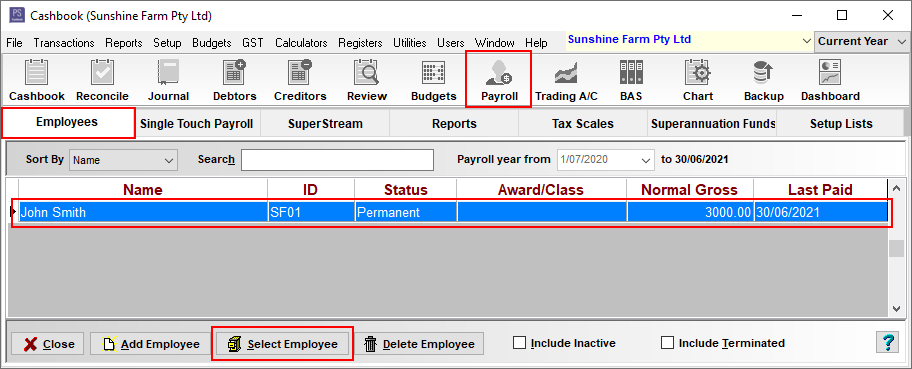

- Click on the Payroll toolbar icon.

- Click on the employee to highlight.

- Click on the Select Employee button. (or double click on the employee).

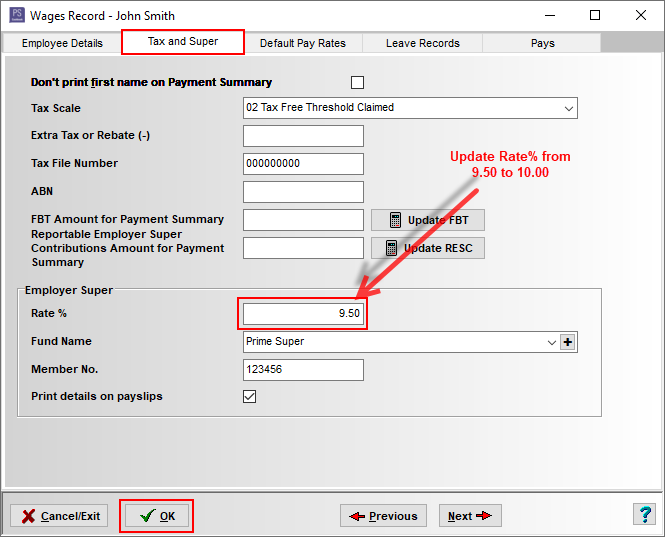

- Click on the Tax and Super tab.

- Update Rate % from 9.50 to 10.00.

- Click OK to save.

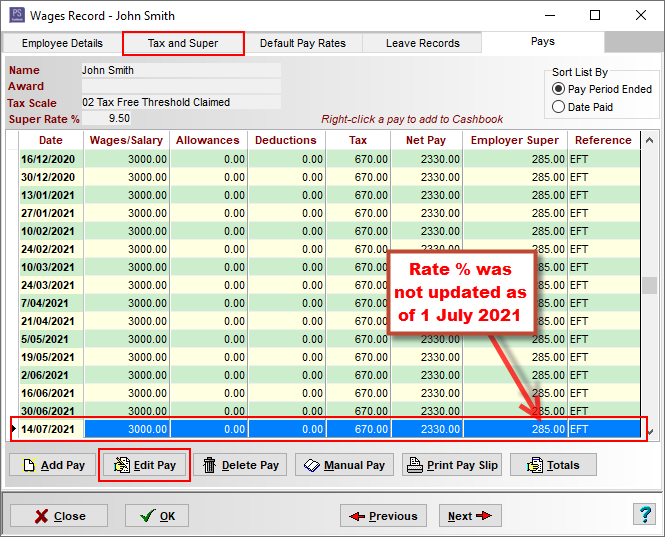

If you enter pays and forget to update your Superannuation SGC Rate %:

- Change rate as above.

- Edit all pays made after 30/06/2020:

- Click on the pay to highlight.

- Click on Edit Pay button.

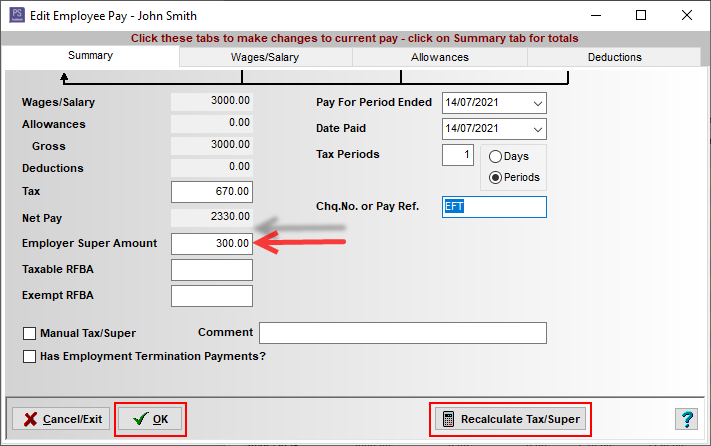

- Click on the Recalculate Tax/Super button.

- This will update the Employer Super Amount.

- Click on OK to save.

Note: ATO Super Guarantee Percentage.

Teamviewer

Teamviewer