PS Cashbook

Adding a Custom/New Tax Scale

Summary

How do I add a new tax scale to the Payroll?

Detailed Description

Cashbook uses standard Australian Taxation Office formula to calculate tax instalment deductions (i.e. how much tax to withhold from your employees' pay.) The formula variables are set up in the Tax Scales tab of the main payroll listing screen.

Tax scales above 74 (flat rates) are not eligible for a Payment Summary (PAYG).

Tax scales above 60 must have an TFN (tax file number) associated with the employee before a Payment Summary (PAYG) can be produced.

You can add your own custom tax rates if the default rates listed are not sufficient. For example, if an employee requires PAYG to be deducted at a flat rate e.g. 20%.

To Add custom Tax Scales:

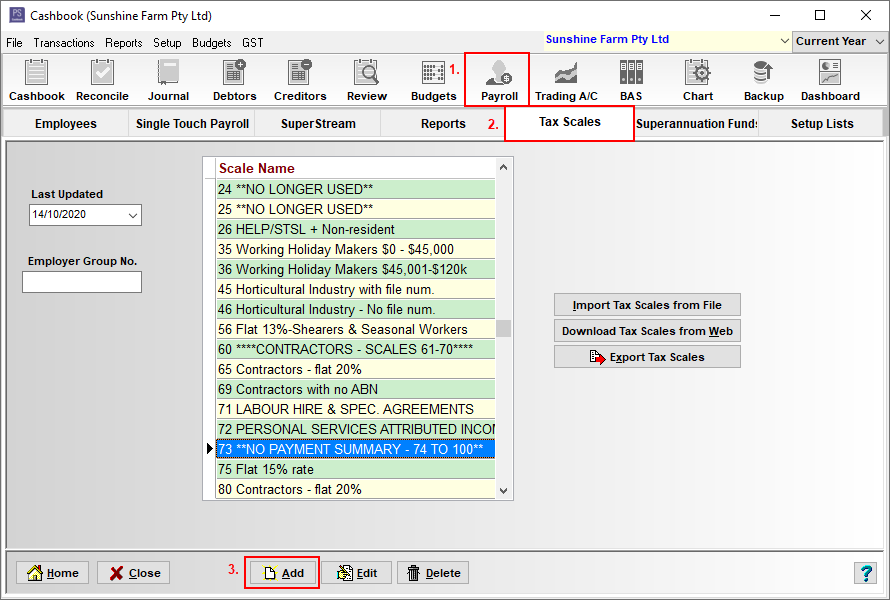

1. Click on the Payroll toolbar option.

2. Click on the Tax Scales tab.

Note: can not assign a new tax scale to a number already in use.

3. Click on the Add button.

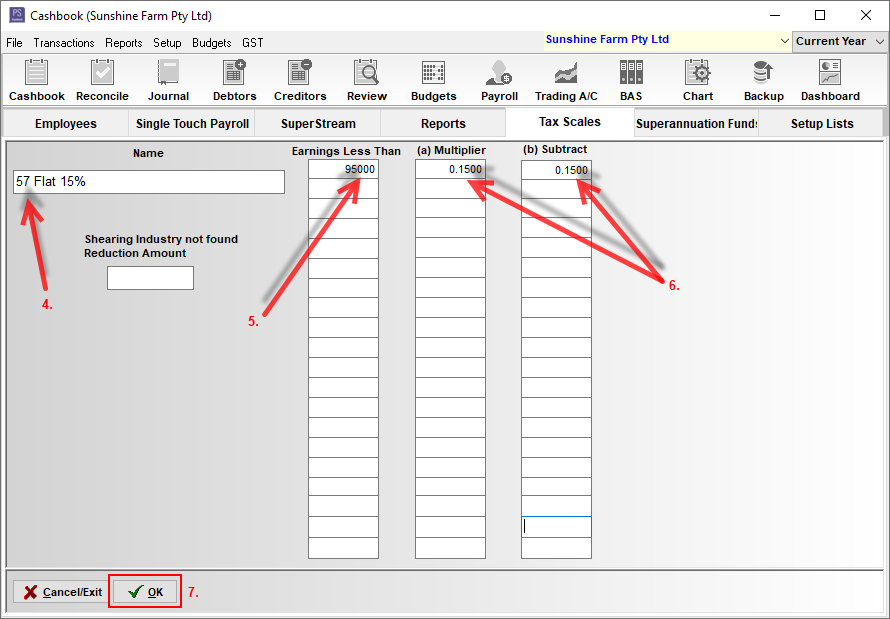

4. Enter the tax scale Name. It must start with a number which is not already in use, followed by a space, then a description. e.g. 57 Flat 15%.

Note: Add a number between 47 and 59. (Note: 56 is already in use for the Flat 13%-Shearers & Seasonal Workers rate).

Note: that employees with a tax scale number 74 to 100 will not have a payment summary printed.

5. Enter a value into each of Earnings Less Than field. (Earnings Less Than amount will always just be 95,000 on the flat rate tax scales.)

6. Enter a value into both the (a) Multiplier, and (b) Subtract fields.

Note: For Multiplier and Subtract values enter as: 15% enter as 0.15; 20% enter as 0.20; 19.5% enter as 0.1950; 13% enter as 0.13, and so on.

Note: If you do not know which values to enter, please consult your accountant.

7. Click on the OK button to save.

8. Click on the Close button to exit.

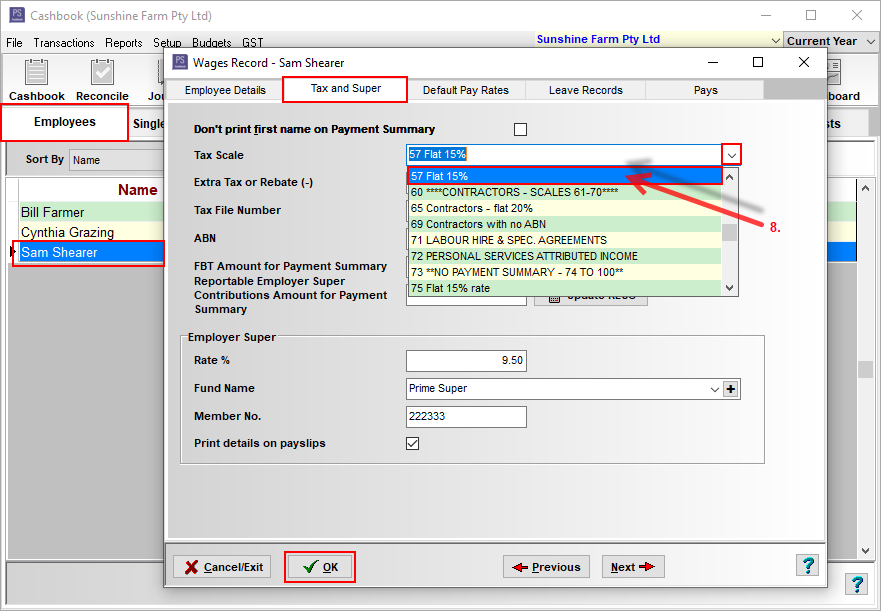

8. You can now select that tax scale for an employee by:

- Click on the Payroll toolbar option.

- Click on the Employees tab.

- Click on the employee you wish to select, so it is highlighted blue.

- Click on Select Employee button.

- Click on the Tax and Super tab.

- Click on the down arrow on the Tax Scale text box to select the new Tax Scale, e.g. 57 Flat 15%.

- Click OK to save.

Teamviewer

Teamviewer