PS Cashbook

End of Year Processing

Summary

End of year Processing

Cashbook remains open for the purposes of adding, editing and deleting transactions for the whole of the financial year, plus one extra month. After this time, Cashbook will no longer allow you to enter data with a date past this period. You must perform Year-end Processing before you can continue to enter data for the next financial year.

You can always access prior year/s information by selecting the required year from the File > Change Accounting Year menu option.

After Year-end processing, any unreconciled transactions are carried forward into the new year and will be displayed in the reconciliation screen.

Detailed Description

Steps to carry out end of year processing:

Step 1

- Backup your company files (all years).

Step 2

- Ensure that all bank accounts have been reconciled for the last day of the financial year. (For example. Reconcile up to 30/06/2021)

PLEASE NOTE: This does not apply to bank accounts that have Usual frequency of reconciliations set to 'Never' in Chart of Accounts setup.

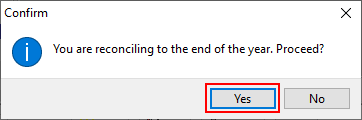

- If you record a reconciliation for the last day of the financial year, you will receive the following prompt to confirm that this will be the last reconciliation for the current financial year.

- Click Yes to complete the reconciliation.

Step 3

- Ensure all BAS returns have been completed up to the end of the financial year.

Step 4

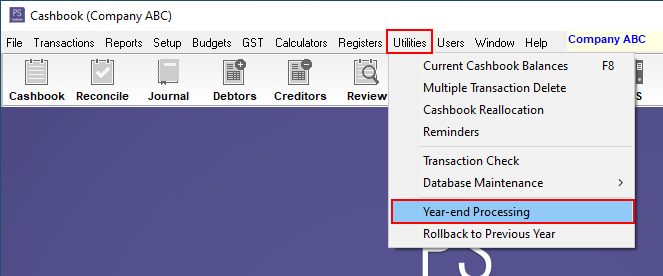

- Click on the Utilities > Year-end Processing menu option.

Step 5

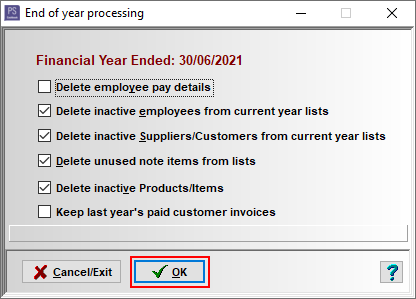

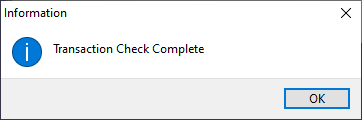

- Click on the OK button.

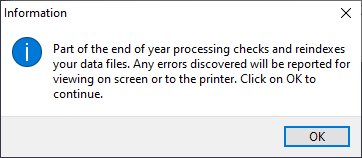

- Click on the OK button.

- Click on the OK button.

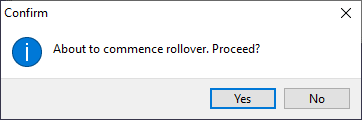

- Click Yes to proceed with rollover.

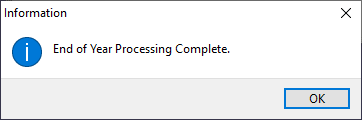

- Click OK.

Possible Errors that you may encounter during the process:

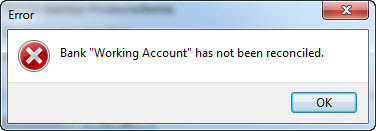

- If you have not reconciled a bank account at all during the financial year, you will receive an error message similar to the following:

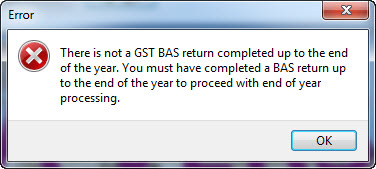

- If you have not completed a GST BAS returns up to the end of the financial year, you will receive an error message:

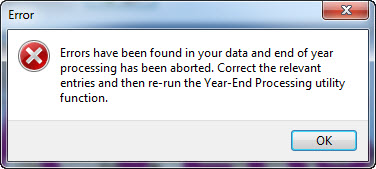

Solution: You will not be able to progress any further until these are completed. Once they are completed, recorded and finalised go back to Step 1.

- Any errors found will stop the rollover from progressing.

The rollover procedure will perform the following functions in the new finanical year

· Create and store a full set of records for the year just completed.

· Delete all entries in all bank accounts and journals, except those in the new financial year..

· Delete all paid invoices for debtors (after a specified date for Cashbook Platinum) & creditors.

· Clear all previous reconciliation details.

· Clear all inactive items from various lists (only for those checked on specification screen).

· Carry forward all unreconciled transactions into the new year.

· Set the opening balance for all trading accounts, banks, assets, liability and equity accounts to be equal to the closing balance for the year just completed. (Not applicable in level 1).

· For Cashbook Plus, copy all existing budgets and roll forward any budget figures e.g. year 2 figures would be moved into year 1, and year 3 to year 2.

· Set last year comparative figures to actuals for the year just completed

Teamviewer

Teamviewer