PS Cashbook

Reconciling the Trial Balance to the Profit and Loss and Balance Sheet Reports

Summary

How do I reconcile my Trial Balance report to the Profit and Loss and Balance Sheet reports?

Detailed Description

This process should become a habit, ensuring that all figures balance across the reports, and that the P & L reflects the movement in the Balance Sheet between two dates. Therefore you should expect to see the P & L result reported in the Balance Sheet as Current Year Profit and Loss.

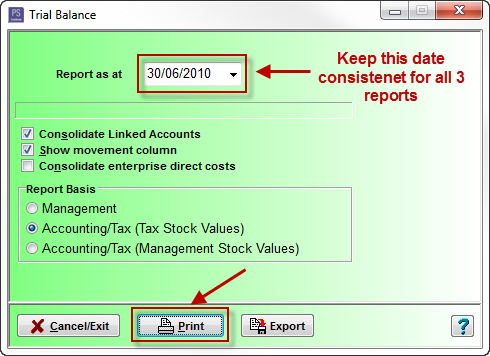

NOTE: It is important to keep date selection for all three reports consistent. This example uses 30 June 2010.

Step 1 -Trial Balance Report

- Click on the Reports > Accounting Detail > Trial balance

- Adjust any default settings and click on the Print button

- The Net Profit figure at the bottom of the Trial Balance report is the number you should expect to see on the P & L report.

- If the trial balance is zero, continue on to create the P & L Report, as in Step 2. If the trial balance does not balance to zero, do not continue until you have completed the next 3 items.

- Click on the Utilities > Transaction Check menu option.

- Correct any errors that are reported and run the transaction check again.

- Repeat this process until the transaction check reports no errors.

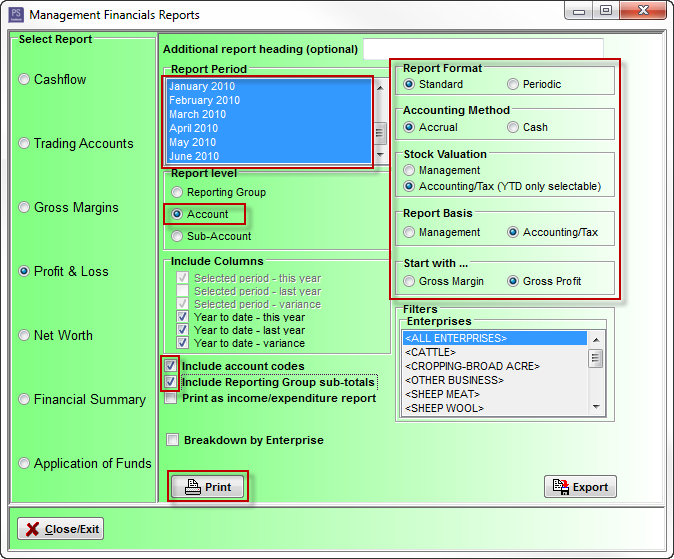

Step 2 - Profit and Loss (P & L) report

- Click on the Reports > Management Financials menu option.

- Select Profit and Loss and ensure you have selected the highlighted options.

- Click on the Print button.

- You should now be presented with the Profit and Loss report with the Net Profit result being consistent as the Trial Balance.

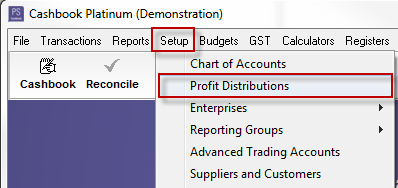

Step 3 - Profit Distribution

- Click on the Chart tool bar option

- Click on the Equity tab

- Check that you have a chart item labelled, 930 – Current Year profit and Loss, (see below)

- If yes, click on the Edit button to check details, as below.

- If no, click on the Add button and create the Equity account, as below.

- Profit Distribution is a simple method of automatically allocating year end profit or loss to owners equity accounts in any nominated proportion. Distributions can be on a percentage basis (e.g. partnerships) and/or a fixed dollar entitlement (e.g. partner salaries, trust distibutions, etc.)

- Set up the profit distribution.

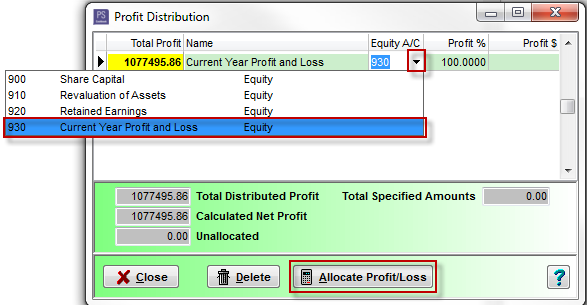

- Click on the Setup > Profit Distributions menu option. You should see the Profit Distribution window shown below (or similar)

- Click on the Allocate Profit/Loss button.

- If you have not set up your Profit Distribution:

- Click on the down arrow

in the Equity A/C column and select your owners equity account. e.g. 930 Current Year Profit and Loss.

in the Equity A/C column and select your owners equity account. e.g. 930 Current Year Profit and Loss. - In the Profit % column, enter your distribution percentage allocation. e.g. 100%. (Fixed dollar entitlements are entered in the Profit $ column.)

- Note: The program will distribute the fixed dollar amounts first and then any % entitlements after that.

- Click on the down arrow

- Click on the Allocate Profit/Loss button.

- Click on the Close button to exit.

Step 4 - Balance Sheet report

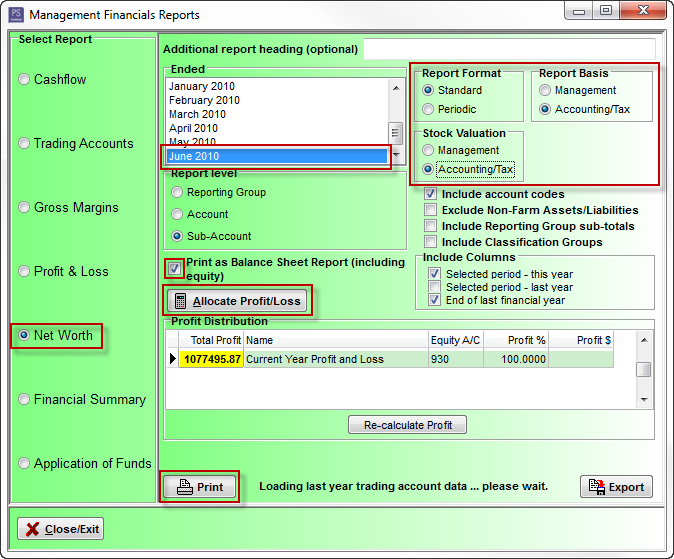

- Click on Reports > Management Financials menu option

- Select the Net Worth report

- Ensure you have selected the highlighted options.

- Click on the Allocate Profit/Loss button.

- Click on the Print button.

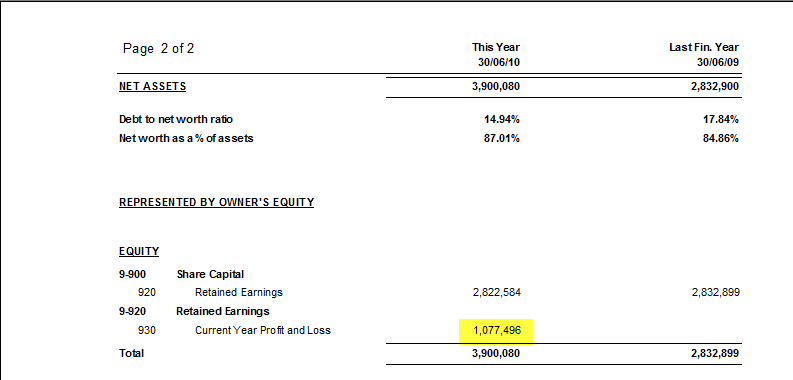

Summary: (See below for an example of the reconciliation outcomes you should be presented with.)

- The Trial Balance result - $1,077,495.87.

- Profit and Loss Report - $1,077,496.

- Profit Distribution - $1,077,495.86.

- Current Year Profit and Loss as per the Balance Sheet (Net Worth Report) - $1,077,496.

Teamviewer

Teamviewer