PS Cashbook

Payroll Wages and Superannuation Accounts Setup

Summary

What payroll accounts do I need to setup in the Chart of Accounts, to enable automatic calculation of tax and superannuation?

Detailed Description

This is a 6-step process:

- Set up a PAYG Liability account (the liability account to which will accrue the amounts withheld from the employee's pay that must be paid to the ATO).

- Set up a superannuation Liability account (the liability account to which will accrue the superannuation amounts that must be paid to nominated super funds).

- Set up an Operating Expense account for wages payments.

- Set up an Operating Expense account for superannuation payments.

- Set up an Other Expense account for the PAYG withheld, linked to the PAYG liability account.

- Set up an Other Expense account for superannuation withheld, linked to the superannuation liability account.

Step 1: Set up a Liability (PAYG) account:

- This account should already be set up in your Chart of Accounts. It would have been part of the "standard chart of accounts" selected as part of your original company setup.

- Click on the Chart toolbar icon.

- Click on the Liabilities tab.

- Click on the account to highlight.

- Click on the Edit button. (Click Add if you need to create this account and duplicate PAYG Withholding liability account chart setup below.)

- The PAYG Withholding liability account should look like this:

Step 2: Set up a Liability (Superannuation) account:

- This account should already be set up in your Chart of Accounts. It would have been part of the "standard chart of accounts" selected as part of your original company setup.

- Click on the Chart toolbar icon.

- Click on the Liabilities tab.

- Click on the account to highlight.

- Click on the Edit button. (Click Add if you need to create this account and duplicate Superannuation liability account chart setup below.)

- The Superannuation liability account should look like this:

Step 3: Set up an Operating Expense account for salary / wages payments

Note: Difference between salary and wages:

- Salaries Expense - Expenses incurred for the work performed by salaried employees during the accounting period. These employees normally receive a fixed amount on a weekly, monthly or annual basis. (i.e. a salaried person is paid a fixed amount per pay period.)

- Wages Expense - Expenses incurred for the work performed by non-salaried employees during the accounting period. These employees receive an hourly rate of pay. (i.e. a wage earner is paid by the hour.)

- This account should already be set up in your Chart of Accounts. It would have been part of the "standard chart of accounts" selected as part of your original company setup, but you may wish to change this to suit your own company.

- Click on the Chart toolbar icon.

- Click on the Expenses tab.

- Scroll down to locate the wages accounts created in company setup.

- Click on the account to highlight.

- Click on the Edit button. (Click Add if you need to create this account and duplicate Wages account chart setup below.)

- All wages expense accounts will have the same Chart setup:

- Account Type: Operating Expense

- GST Category: 10. Non-reportable Payments

- Reporting Group: 3-330 Labour

- Tick Wages Account checkbox.

- Allocate Default Enterprise here if applicable.

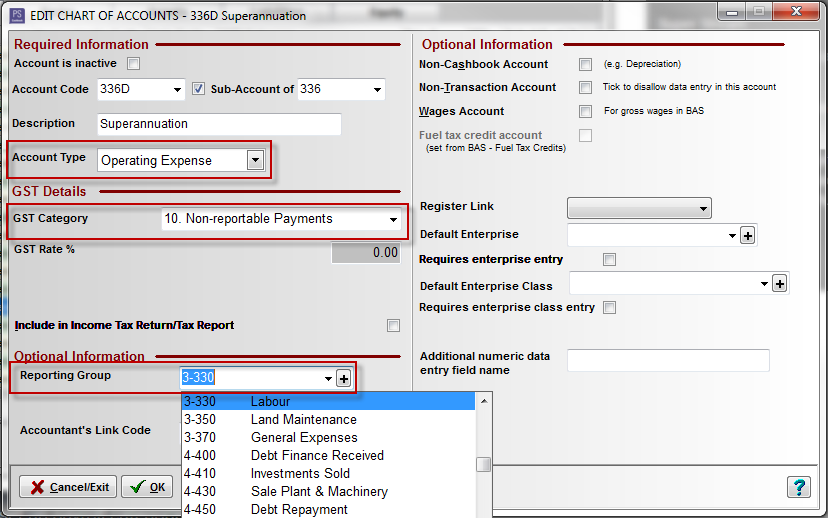

Step 4: Set up an Operating Expense account for superannuation payments

- This account should already be set up in your Chart of Accounts. It would have been part of the "standard chart of accounts" selected as part of your original company setup, but you may wish to change this to suit your own company.

- Click on the Chart toolbar icon.

- Click on the Expenses tab.

- Scroll down to locate the superannuation account created in company setup.

- Click on the account to highlight.

- Click on the Edit button. (Click Add if you need to create this account and duplicate Superannuation account chart setup below.)

- All superannuation expense accounts will have the same chart setup:

- Account Type: Operating Expense

- GST Category: 10. Non-reportable Payments

- Reporting Group: 3-330 Labour

- Allocated Default Enterprise here if applicable.

Step 5: Set up an Other Expense account for PAYG withheld, linked to the PAYG liability account

- This account should already be setup in your Chart of Accounts. It would have been part of the "standard chart of accounts" selected as part of your original company setup.

- Click on the Chart toolbar icon.

- Click on the Expenses tab.

- Scroll down to locate the PAYG Withholding Other Expense account created in company setup.

- Click on the account to highlight.

- Click on the Edit button. (Click Add if you need to create this account and duplicate PAYG withheld Other Expense account chart setup below.)

- The PAYG Withholding other expense account should look like this:

Step 6: Set up an Other Expense account for superannuation withheld, linked to the superannuation liability account

- You will probably have to create this account yourself.

- Click on the Chart toolbar icon..

- Click on Add button at the bottom of the window.

- Add the following account details:

- Account Code: SUPR

- Description: Superannuation Withheld

- Account Type: Other Expense

- GST Category: 10. Non-reportable Payments

- Reporting Group: 5-599 Taxation

- Balance Sheet Link: 805 Superannuation Clearing Acc

- Note: Balance Sheet Link - links other expense/income accounts to corresponding Balance Sheet account.

- Click on the OK button to save.

- You are now ready to add an employee to Payroll. Click the following link: Adding an Employee.

Teamviewer

Teamviewer