PS Cashbook

Payroll - Wages & Super Accounts Setup

Summary

What accounts do I need to set up in the Chart of accounts, so I can automactically enter pay transactions into Cashbook?

Detailed Description

As part of Employee Details setup, you have the option to Add Pay Transactions to Cashbook. You made need to setup the appropriate accounts in your Chart of Accounts. (see below):

Accounts required are:

- An Operating Expense account for wages payments.

- An Operating Expense account for superannuation payments.

- A superannuation Liability account. (the liability account to which the superannuation amounts that must be paid to nominated super funds accrue.)

- An Other Expense account for superannuation withheld, linked to the superannuation liability account.

Step 1: Set up an Operating Expense account for salary / wages payments:

Note: Difference between salary and wages:

- Salaries Expense - Expenses incurred for the work performed by salaried employees during the accounting period. These employees normally receive a fixed amount on a weekly, monthly or annual basis. (i.e. a salaried person is paid a fixed amount per pay period.)

- Wages Expense - Expenses incurred for the work performed by non-salaried employees during the accounting period. These employees receive an hourly rate of pay. (i.e. a wage earner is paid by the hour.)

- This account should already be set up in your Chart of Accounts. It would have been part of the "standard chart of accounts" selected as part of your original company setup, but you may wish to change this to suit your own company.

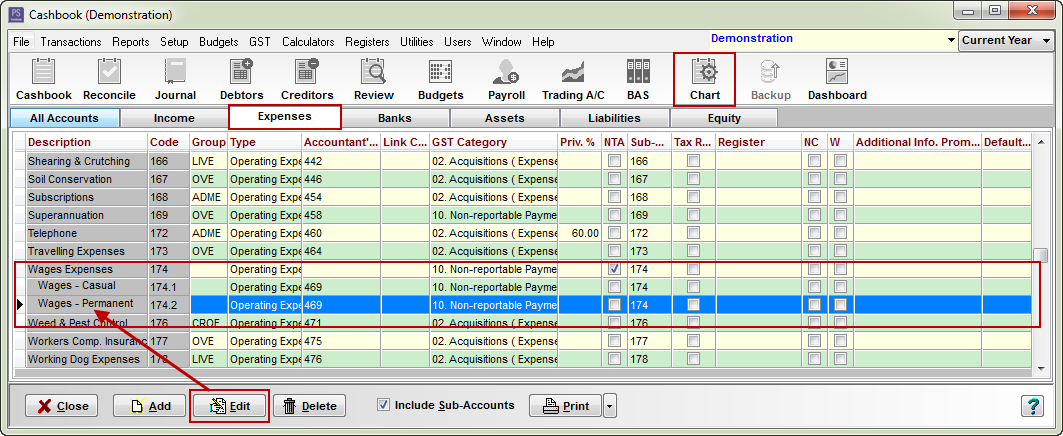

- Click on the Chart toolbar icon.

- Click on the Expenses tab.

- Scroll down to locate the wages accounts created in company setup.

- Click on the account to highlight.

- Click on the Edit button. (Click Add if you need to create this account and duplicate Wages account Chart setup below.)

- All wages expense accounts will have the same Chart setup:

- Account Code: Usually in the 100's number range.

- Description: up to user eg. Wages - Permanent

- Account Type: Operating Expense

- GST Category: 10. Non-reportable Payments

- Reporting Group: optional

- Tick Wages Account check box.

- Allocated Default Enterprise here if applicable.

Step 2: Set up an Operating Expense account for Superannuation payments

- This account may already be set up in your Chart of Accounts. It would have been part of the "standard chart of accounts" selected as part of your original company setup, but you may wish to change this to suit your own company.

- Still in Chart list.

- Click on the Expenses tab.

- Scroll down to locate the superannuation account created in company setup.

- Click on the account to highlight.

- Click on the Edit button. (Click Add if you need to create this account and duplicate Superannuation account Chart setup below.)

- Chart set up:

- Account Type: Operating Expense

- GST Category: 10. Non-reportable Payments

- Reporting Group: optional

- Allocated Default Enterprise here if applicable.

- Click on the OK button to save.

Step 3: Set up a Liability (Superannuation) account:

(This is account setup is optional. Setup if you wish your superannuation liability to appear in your Cashflow and Balance Sheet Reports.)

- Still in Chart list.

- Click on the Add button.

- Enter the following information:

- Account Code: 706 (Note: If using Cashbook "standard chart of accounts" codes, selected as part of your original company setup, the Liability accounts are usually in the 700's number range.)

- Description: Superannuation Payable

- Account Type: Liability

- GST Category: 11. Non-reportable Receipts

- Click the OK button to save.

- The Superannuation liability account should look like this:

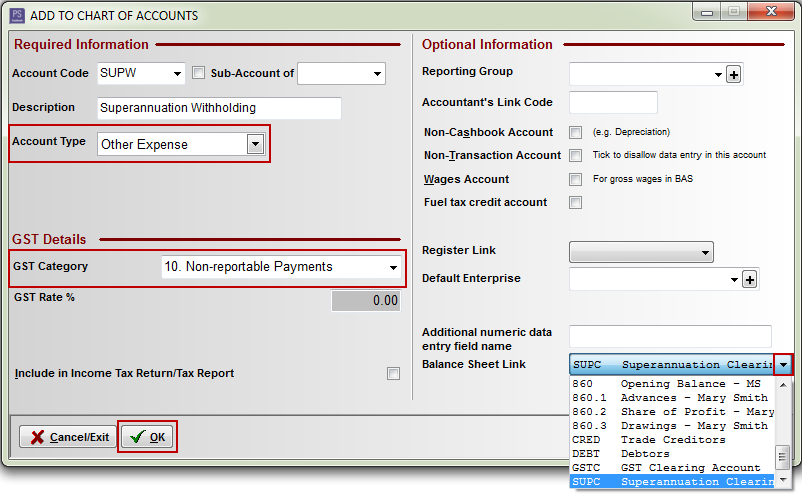

Step 4: Set up an Other Expense account for Superannuation withheld (owing), linked to the superannuation liability account

- This account you will probably have to create yourself.

- Still in Chart.

- Click on Add button at the bottom of the window.

- Add the following account details:

- Account Code: SUPW

- Description: Superannuation Withholding

- Account Type: Other Expense

- GST Category: 10. Non-reportable Payments

- Reporting Group: optional

- Balance Sheet Link: SUPC Superannuation Clearing Acccount (Created in Step 3) (If you did not opt to add the Superannuation Liability Account in Step 3, you cannot create a Balance Sheet Link.)

- Note: Balance Sheet Link - links other expense/income accounts to corresponding Balance Sheet account.

- Click on the OK button to save.

- You are now ready to add an employee to Payroll, click the following link: Adding an Employee.

Teamviewer

Teamviewer