PS Cashbook

Adding an Asset Account

Summary

How do I create an Asset account?

Detailed Description

These instructions relate to adding an Asset account to your Chart of Accounts. Also have a look at the Kowledge Base item on Entering An Asset Purchase.

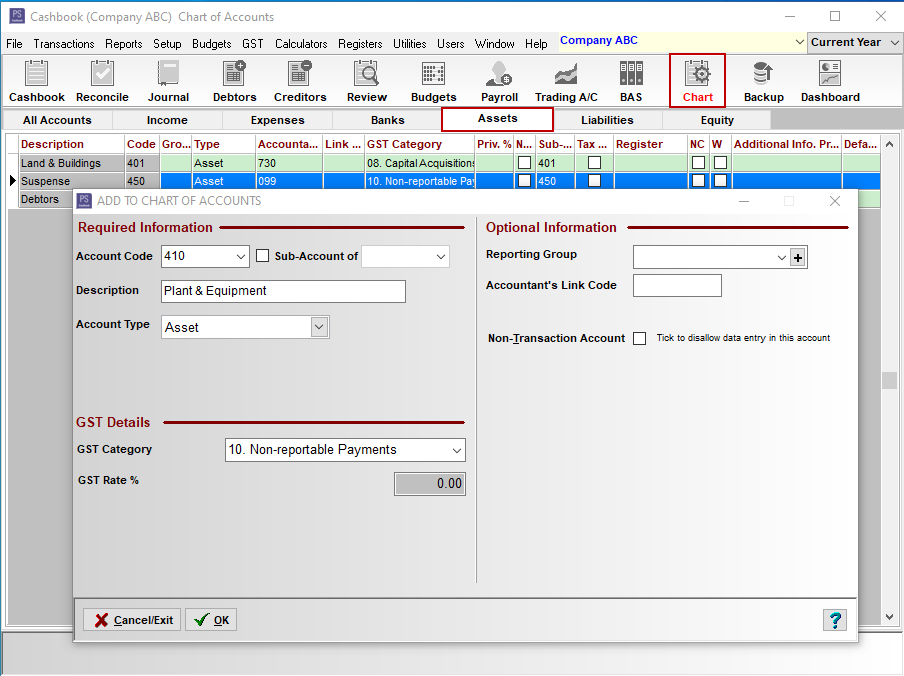

Step 1.

- Click on the Chart toolbar icon.

- Click on the Assets tab.

- Click on the Add button.

- In the Add to Chart of Accounts window enter:

- Account Code - e.g. 410 (one that is not used and similar code series e.g. exisint account codes are 401, 450)

- Description - e.g. Plant & Equipment

- Account Type - Asset

- GST Category - 10. Non-reportable Payments

- Check with your accountant or advisor about assigning the optional Reporting Group and Accountant's Link Code.

- Click on the OK button to save.

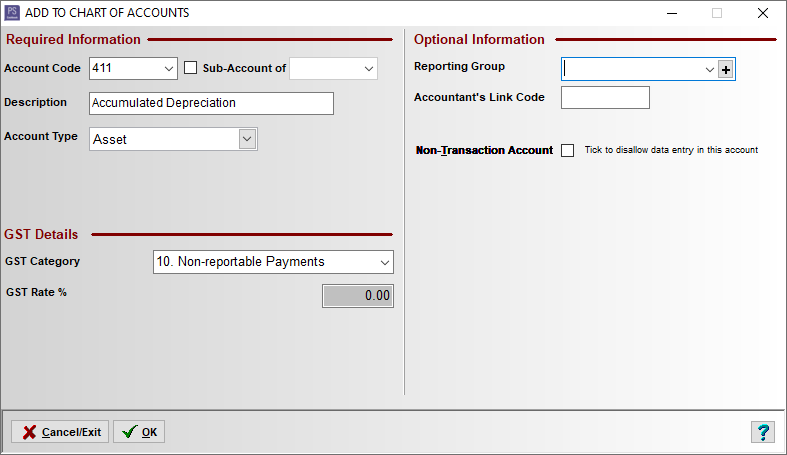

Step 2. - Add an Accummulated Depreciation account (contra Asset account)

You can depreciate most types of tangible property such as buildings, equipment, vehicles, machinery and furniture, so you may need to also add an Accumulated Depreciation account.

Note: Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life. Accumulated depreciation is a contra asset account, meaning its natural balance is a credit that reduces the overall asset value.

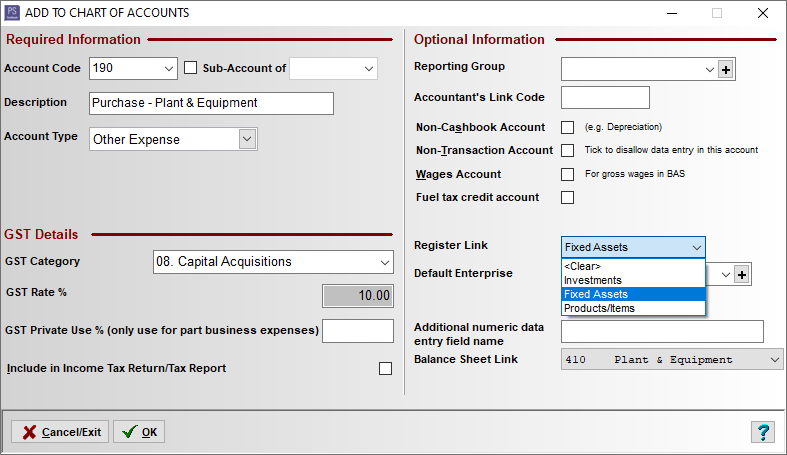

Step 3. - Create an Other Expense account for the purchase of the asset which links to the corresponding balance sheet account - (Asset) Plant & Equipment.

- Click on the Chart toolbar icon.

- Click on the Expenses tab.

- Click on the Add button.

- In the Add to Chart of Accounts window enter:

- Account Code - e.g. 190 (one that is not used and similar code series e.g. exisint account codes are 100's)

- Description - e.g. Purchase - Plant & Equipment

- Account Type - Other Expense

- GST Category - 08. Capital Acquisitions

- Check with your accountant or advisor about assigning the optional Reporting Group and Accountant's Link Code.

- Register Link - select Fixed Assets from the drop-down menu.

- Balance Sheet Link - select the asset account you just created e.g. 410 Plant & Equipment.

- Click on the OK button to save.

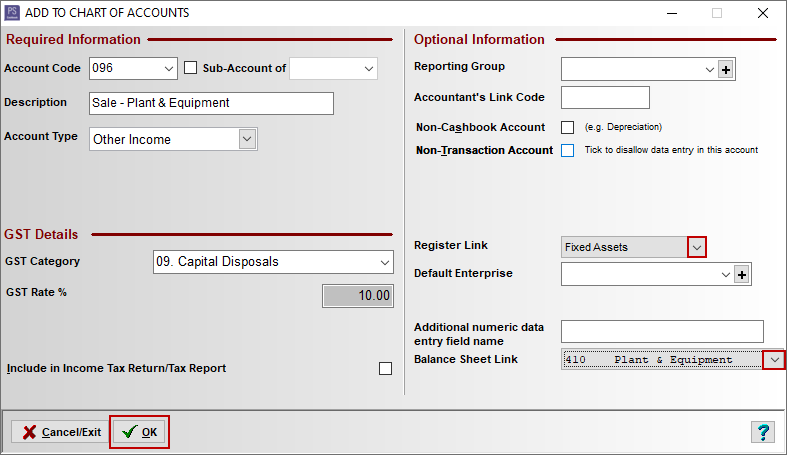

Step 4. - Create an Other Income account for the sale of the asset which links to the corresponding balance sheet account - (Asset) Plant & Equipment.

- Click on the Chart toolbar icon.

- Click on the Expenses tab.

- Click on the Add button.

- In the Add to Chart of Accounts window enter:

- Account Code - e.g. 096 (determined by your Chart setup.)

- Description - e.g. Sale - Plant & Equipment

- Account Type - Other Income

- GST Category - 08. Capital Disposals

- Check with your accountant or advisor about assigning the optional Reporting Group and Accountant's Link Code.

- Register Link - select Fixed Assets from the drop-down menu.

- Balance Sheet Link - select the asset account you just created e.g. 410 Plant & Equipment.

- Click on the OK button to save.

Teamviewer

Teamviewer