PS Cashbook

Recording an Asset Purchases

Summary

How do I record the purchase of an asset?

Detailed Description

Click on the following Knowledge Base item link: Adding an Asset account and Balance Sheet Linked accounts, to make sure you have the correct account codes necessary to record the purchase of an Asset.

Step 1.

- Click on the Cashbook toolbar option.

- Click on the Add button.

- Click Yes to the Confirm message: ' Do you want to enter transactions for "Bank Account", in the file "Company ABC"?

Step 2.

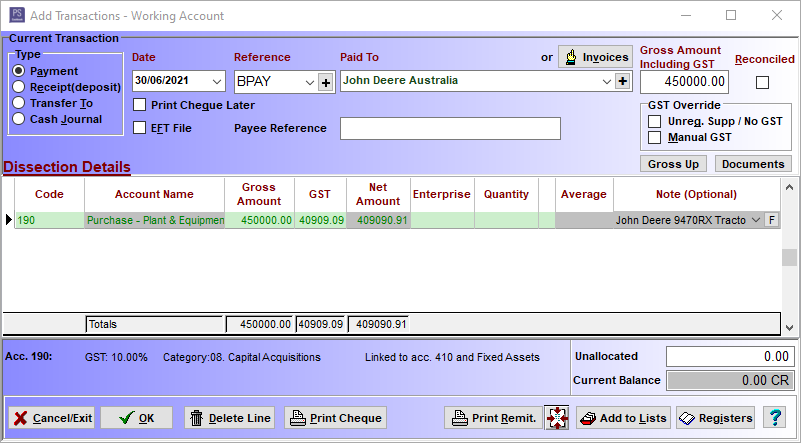

In the Add Transactions window:

- Type - Payment

- Date -

- Reference - EFT, BPAY etc

- Paid To - name of supplier e.g. John Deere Financial

- Gross Amount Including GST - amount paid

- Dissection Details

- Code - account code of purchase account

- Enterprise - optional

- Quantity - optional

- Note - name of fixed asset purchase

- Click on the tab key - this will take you to the Fixed Asset register.

Step 3.

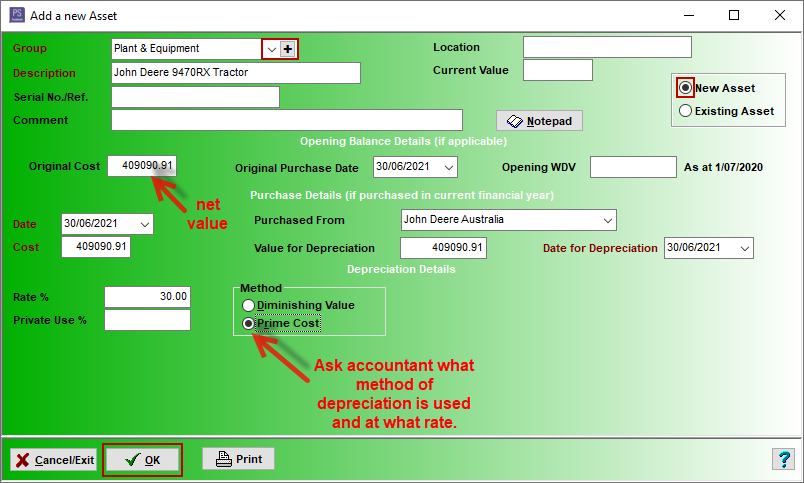

Note: Adding an item to the Fixed Asset Register is only applicable to those on Level 4.

- Enter details.

Note: value of asset does not include GST (net).

For example:

- Click OK to save.

- Click OK to save transaction.

Click on the following Knowledge Base link for Setup loan accounts to finance an asset purchase.

Teamviewer

Teamviewer