PS Cashbook

Payroll - Add an Employee

Summary

How do I add an employee to payroll?

Detailed Description

- Click on the Payroll toolbar icon.

- A list of employees will be displayed.

- From the Employees list box in the Payroll screen

- Click on the Add Employee button.

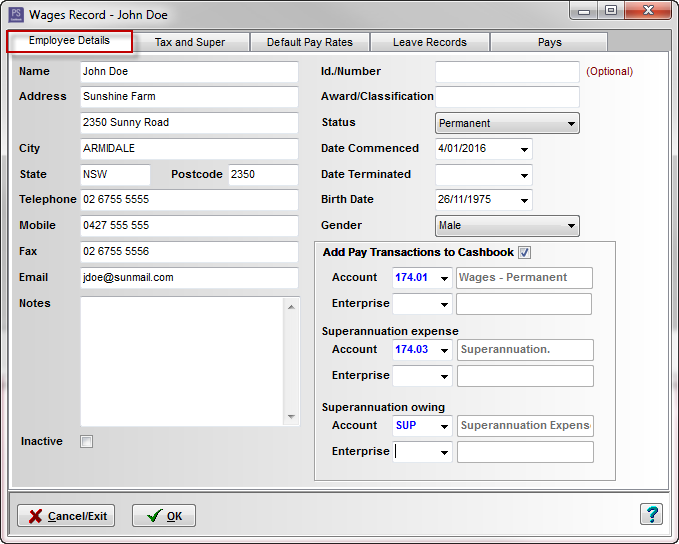

- Click on the Employee Details tab and enter details as applicable:

- Name - enter first name then surname, e.g. John Doe.

- Address details

- Contact information - e.g. telephone , mobile, email.

- Id./Number - Optional. i.e. an employee number.

- Award/Classification - Optional, e.g. Shearer, Station Hand, etc.

- Status - e.g. casual or permanent.

- Date Commenced

- Birth Date

- Gender - e.g. Male or Female.

- Tick the Add Pay Transactions to Cashbook box, if you want your wages payroll transactions to also be added Cashbook when recorded.

- Click on the following link for step-by-step instructions on how to set up wages and superannuation accounts in Chart for payroll.

For Example:

- Click on the Tax and Super tab.

- Select Tax Scale from the drop down list.

- Enter any amount for Extra Tax or Rebate (-) per pay period. Enter as a negative number for tax rebate amounts.

- Tax File Number (TFN)

- ABN (Australian Business Number) - if applicable.

- FBT Amount for Payment Summary, if applicable.

- Reportable Employer Super Contributions Amount for Payment Summary - this is where total amount of Salary Sacrifice is added, so it appears on the PAYG Payment Summary.Click on the following link for more information: Salary Sacrifice - Adding to Payment Summary.

- Employer superannuation Rate % - e.g. 9.5% For Current

- Superannuation Fund Name - select from drop down list or click on + button to add. Click on the following link to Add a Superannuation Fund (Superfund Lookup).

- Superannuation Member No.

- Click OK to save.

For Example:

- Click on the following link to Setup default pay/rates for an employee.

Was this helpful?

Not helpful (

) Very helpful

Teamviewer

Teamviewer