PS Cashbook

SuperStream - Employee Tax and Superannuation Fund Details Setup

Summary

How do I set up Tax and Superannuation Fund Employee Details for SuperStream in Payroll?

Detailed Description

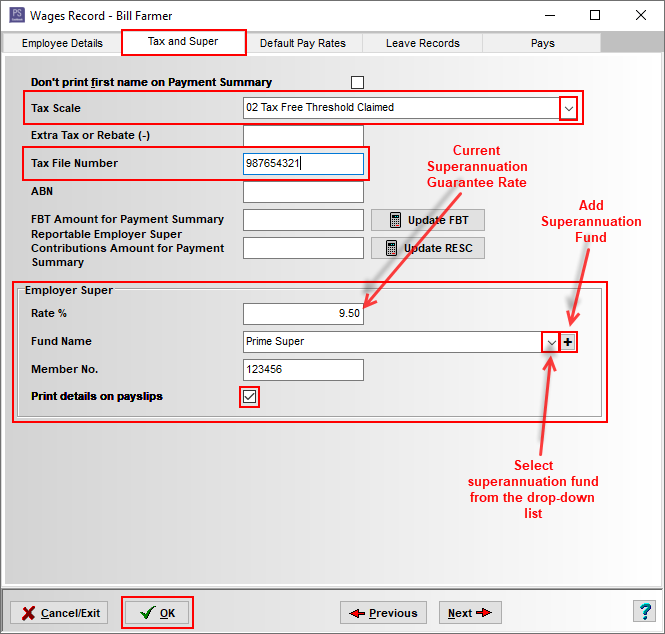

Step 1 - Ensure all employee Superannuation fund details are entered, including Tax Scale and Tax File Number (TFN):

- Click on the Payroll toolbar icon.

- Click on the Employees tab.

- Click on an employee to highlight.

- Click on the Select Employee button.

- Click on the Tax and Super tab.

- Tick Don't print first name on Payment Summary if a company or other entity (other than an individual).

- Tax Scale - select from drop-down list. - required

- Enter any amount for extra tax per pay period. Enter as a negative number for tax rebate amounts.

- Tax File Number (TFN) - required

- ABN (Australian Business Number)

- Employer Super (Helpful Hint: get your employee to fill out a Superannuation (super) Standard Choice Form.)

- Superannuation Rate % (For current Superannuation Guarantee Rate click on the following ATO link.) - required

- Superannuation Fund Name.

- Click on the + button to add a superannuation fund.

- Click on the drop-down arrow to select a superannuation fund from the list - required

- Member No. (Fund Member Number) - required

- Click OK to save.

To accessed this window:

- Click on the Payroll toolbar icon.

- Click on the Superannuation Funds tab.

- Click on the Add button.

- In the Add Super Fund window:

- Click on one of the Search By: options, i.e. USI, ABN or Name.

- Enter their respective information in the text box.

- Click on the Search button.

This will take you to the Fund Search Results window:

- All Matching Products will populate this window.

ABN

- The Australian Business Number (ABN) is an 11 digit, unique number issued to a business (entity), and used to identify that business (entity). i.e. the superannuation fund.

For example: 70 815 369 818 is the ABN that identifies the IOOF Portfolio Service Superannuation Fund.

USI

- The Unique Superannuation Identifier (USI) is a number used by larger superannuation funds for electronic communication about contributions and rollovers.

- The Unique Superannuation Identifier (USI) is used in SuperStream to identify an APRA fund and/or its superannuation product which an employee (member) is contributing to.

For example: The IOOF Portfolio Service Superannuation Fund has 23 superannuation products, each with their own USI. e.g. IOF0057AU, IOF0058AU, IOF0059AU, etc....

Product Name

- A super fund may offer numerous super products, for example, a retail superannuation plan and an employer superannuation plan.

- Each product will have its own USI and its matching Product Name.

For example: USI: IOF0057AU, Product name: IOOF Portfolio Service Personal Superannuation.

- To select a product, simply click on that product, so it is highlighted blue.

- Click on the OK button.

- Click on the following link for SuperStream - Employee Details Setup.

- Click on the following link for SuperStream - Employer Details Setup.

Teamviewer

Teamviewer